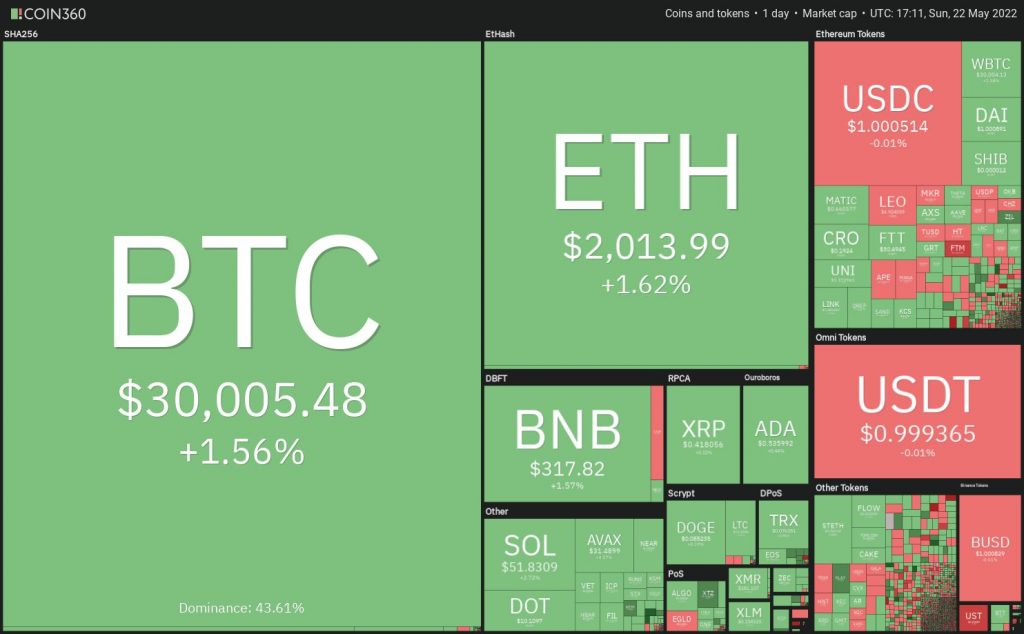

BTC value keeps on experiencing selling pressure, yet a concise convention or the beginning of a combination could prompt sharp gains in BNB, XMR, ETC, and MANA.

The Dow Jones Industrial Average has declined for eight back-to-back weeks, the first such long string of failures starting around 1923.

On May 20, the S&P 500 momentarily fell into the bear market an area, demonstrating that brokers keep on selling dangerous resources in apprehension about a downturn.

Because of its tight relationship with US values markets, Bitcoin (BTC) has stayed under tension for a long time, The bulls are endeavoring to push Bitcoin higher during the end of the week and turn away a significantly longer series of failures.

(BTC) Bitcoin’s presentation in the initial five months has been the most terrible starting around 2018, demonstrating that merchants are in charge. Be that as it may, following half a month of shortcoming, the crypto markets might be on the cusp of a bear market rally.

What are the basic levels that might flag the beginning of a supported recuperation? How about we concentrate on the diagrams of the best 5 cryptographic forms of money that might beat in the close to term.

BTC/USDT

Bitcoin (BTC) bounced back off the essential help at $28,630 on May 20, showing solid purchasing close to this level. The bulls are endeavoring to push the cost over the downtrend line, which could be the main sign that the selling strain might diminish.

Over the downtrend line, the BTC/USDT pair could ascend to the 20-day outstanding moving normal ($31,887). The bears are probably going to protect this level with energy.

Assuming that the cost diverts down from the 20-day EMA, the bears will buy and buy and attempt to sink the pair underneath $28,630.

Assuming they figure out how to do that, the pair could drop to $26,700. This is a significant level to watch out for because a break and close underneath it could open the entryways for decay to $25,000 and afterward to $21,800.

Alternately, assuming purchasers push the cost over the 20-day EMA, the pair could endeavor an assembly to the 61.8% Fibonacci retracement level at $34,823. On the off chance that this level is scaled, the pair could move to the 50-day basic moving normal ($37,289).

The 4-hour diagram shows that the cost is getting pressed between the downtrend line and $28,630. The 20-EMA and the 50-SMA have leveled out and the general strength record (RSI) is over the midpoint recommending a harmony among the organic market.

This equilibrium could shift for purchasers on the off chance that they push and support the cost over the downtrend line. Assuming that occurs, the pair could begin its north walk toward the 200-SMA.

Going against the norm, if the cost diverts down from the ongoing level, the bears will endeavor to sink the pair beneath $28,630 and gain the advantage.

BNB/USDT

Binance Coin (BNB) recuperated forcefully from the basic help at $211 and has arrived at the upward obstruction at the 20-day EMA ($323).

This is a significant level for the bears to safeguard because a break and close above it could show that a base might be set up.

Over the 20-day EMA, the BNB/USDT pair could mobilize to $350 and from there on to the 50-day SMA ($376). This level could again go about as a solid obstacle however assuming bulls push the cost above it, the pair could revitalize to the 200-day SMA ($451).

In opposition to this suspicion, assuming the cost diverts down forcefully from the 20-day EMA, it will propose that bears have not yet surrendered and they keep on selling at more elevated levels. The pair could then drop toward $211.

Assuming that the cost bounces back off this level, the pair might combine somewhere in the range of $211 and $320 for a couple of days.

The bulls are endeavoring to push the cost over the upward opposition at $320. Assuming they succeed, the pair could energize toward $350. The bears are probably going to forcefully guard this level. Assuming the cost diverts down from $350, the pair could again drop to $320.

If the cost bounces back off this level, the pair could remain range-bound somewhere in the range of $320 and $350 for quite a while. The bullish energy could get over the 200-SMA and the pair might revitalize to $380 and later to $400.

Alternately, assuming the cost diverts down from the ongoing level, the pair could drop to $286 and afterward to $272.

XMR/USDT

Monero (XMR) dipped under major areas of strength at $134 on May 12 yet the bears couldn’t support the lower levels. This proposes forceful purchasing on plunges. The cost has recuperated strongly to the 20-day EMA ($179).

On the off chance that bulls push and support the cost over the 20-day EMA, the XMR/USDT pair could ascend to the upward obstruction zone between the 200-day SMA ($202) and the 50-day SMA ($212). The bears are supposed to mount areas of strength and in this zone.

Assuming that the cost diverts down from this zone yet bulls capture the ensuing decay at the 20-day EMA, it will propose a possible change in pattern. Alternately, assuming the cost diverts down from the ongoing level, the bears will attempt to pull the pair to $150 and from that point to $134.

The 4-hour outline shows the development of more promising low points and better upsides. The bears attempted to pull the cost underneath the 50-SMA yet the bulls protected the level effectively. This recommends an adjustment of feeling from selling on conventions to purchasing on plunges.

The pair could next energize to the 200-SMA where the bears might offer areas of strength for a. Assuming bulls conquer this hindrance, the pair could revitalize to $225. In opposition to this supposition, assuming the cost turns down and breaks beneath the 50-SMA, the pair could slide to $150. A break underneath this level could challenge areas of strength for the $134.

Related: Dollar Cost Averaging or Lump-sum: Which Bitcoin strategy works best regardless of price?

ETC/USDT

Ethereum Classic (ETC) dropped strongly from $52 on March 29 to $16 on May 12. The bulls are endeavoring to begin a recuperation that could confront opposition at the 20-day EMA ($23).

On the off chance that the cost diverts down from the 20-day EMA, the bears will again endeavor to continue the downtrend by pulling the ETC/USDT pair underneath the basic help at $16.

Going against the norm, if purchasers push the cost over the 20-day EMA, it will recommend the beginning of a more grounded alleviation rally. The positive uniqueness of the RSI likewise focuses on the chance of recuperation in the close to term.

The pair could then ascent to the 38.2% Fibonacci retracement level at $30 where the bears might mount areas of strength for a.

The cost has been exchanged somewhere in the range of $19 and $23 for quite a while. This proposes that the bulls are endeavoring to frame a higher low however the bears keep on representing serious areas of strength at more significant levels. The straightening 20-EMA and 50-SMA don’t give a reasonable benefit either to bulls or bears.

Assuming that purchasers drive the cost above $23, it will propose the beginning of another up-move. The pair could initially revitalize to the 200-SMA and afterward to $33. On the other hand, if the cost turns down and falls beneath $19, the bears will acquire the advantage. They will then endeavor to sink the pair to $16.

MANA/USDT

Decentraland (MANA) diverted down from the 20-day EMA ($1.24) on May 16 however a positive sign is that the bulls didn’t permit the cost to support beneath the mental level at $1.

Yet again the purchasers will endeavor to push the cost over the 20-day EMA. The MANA/USDT pair could energize the 50-day SMA ($1.72) if they succeed. The bears may again mount a solid opposition at this level yet assuming that bulls clear this obstacle, the pair could begin its north walk toward the 200-day SMA ($2.72).

As opposed to this supposition, if the cost slips underneath $1, the bears will attempt to sink the pair to the urgent help at $0.60. A break and close underneath this level could begin the following leg of the downtrend.

The pair is stuck somewhere in the range of $0.97 and $1.36, showing that bulls are purchasing the plunges underneath $1 and the bears are selling on assemblies. The 20-EMA and the 50-SMA have straightened out, showing that the solidification might go on for some additional time.

Assuming purchasers move the cost over the 50-SMA, the pair could ascend to the obstruction of the reach at $1.36. The bullish force could get assuming that purchasers defeat this boundary. Alternately, the bears could acquire the high ground if the cost turns down and falls beneath the help at $0.97.

#BTC #Bitcoin Price #BNB #XMR #ETC #MANA

READ MORE-