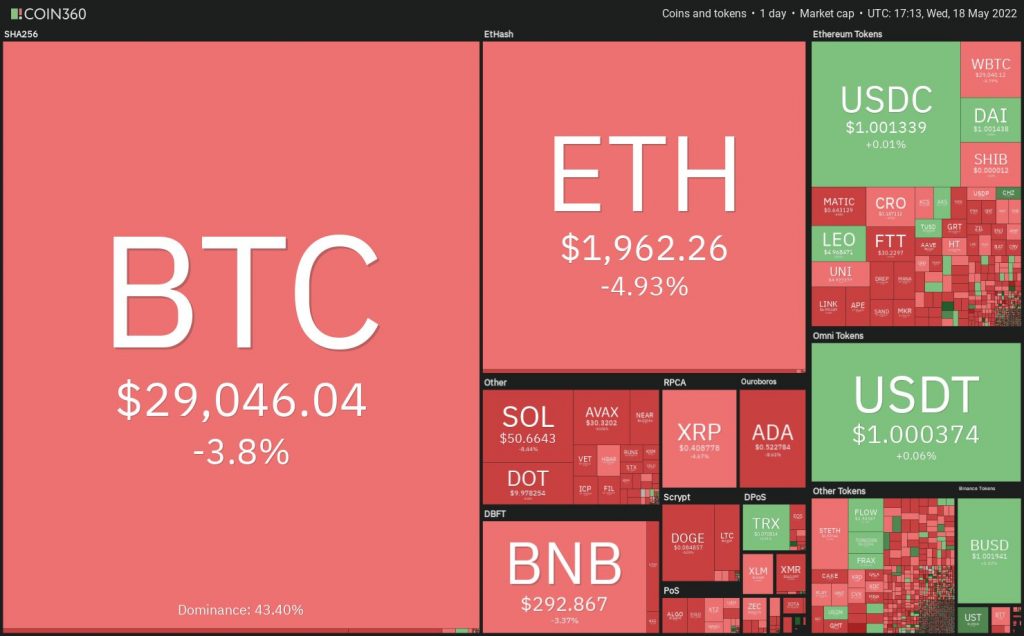

Debilitated financial exchanges keep on affecting crypto costs and specialized examination recommends BTC is in danger of falling underneath its new $25,500 low.

On May 17, United States Federal Reserve Chairman Jerome Powell told the Wall Street Journal that the 50-premise point rate climbs would go on until expansion is taken care of.

Powell’s accentuation of a hawkish approach recommends that money-related conditions are probably going to stay tight in 2022, which could restrict the potential gain in unsafe resources.

On-chain market knowledge firm Glassnode said that by and large, Bitcoin (BTC) has reached as far down as possible when the cost breaks underneath the acknowledged cost.

Be that as it may, excepting the 2019 to 2020 bear market, during past bear cycles, (BTC) Bitcoin’s cost remained underneath the acknowledged cost for any place between 114 to 299 days. That’s what this recommends if large-scale circumstances are not positive, a speedy recuperation is improbable.

While the ongoing decrease in U.S. value markets and Bitcoin have likenesses with the accident in March 2020, the recuperation may not follow a similar direction since economic situations are unique.

In 2020, the Fed upheld the business sectors with a phenomenal boost, yet in 2022 the emphasis will stay on diminishing expansion and money-related fixing.

Could Bitcoin and altcoins continue their downtrend or will bring down levels draw in purchasing? How about we concentrate on the diagrams of the best 10 digital currencies to find out.

BTC/USDT

BTC, Bitcoin’s recuperation neglected to transcend the 38.2% Fibonacci retracement level at $31,721 proposing that the pattern stays negative and brokers are selling on minor assemblies.

The BTC/USDT pair could drop to the quick help at $28,630. Assuming the cost bounce back off this level, the pair could unite somewhere in the range of $28,630 and $31,721 for quite a while.

A break and close over the 20-day dramatic moving normally (EMA) ($32,979) will be the principal indication of a likely change in pattern. The pair could then energize to the 61.8% retracement level at $34,823.

Then again, assuming the cost slips beneath $28,630, the bears will attempt to solidify their situation by pulling the pair underneath $26,700. Assuming that occurs, the negative energy could get and the pair might slide to $25,000 and from there on to $21,800.

ETH/USDT

Ether’s (ETH) inability to transcend the upward obstruction at $2,159 may have enticed momentary brokers to book benefits. That pulled the cost beneath $1,940 however the bulls are endeavoring to shield the level.

If the cost bounces back off $1,940 with strength, the ETH/USDT pair could again ascend to $2,159. The bulls should push and support the cost above $2,159 to make the way for a meeting to the 20-day EMA ($2,353). A break and close over this obstruction will recommend that the business sectors have dismissed the lower levels.

On the other hand, if bears support the cost beneath $1,940, the pair could decline to the vital help at $1,700. This is a significant level to watch out for because a break underneath it could bring about alarm selling. The pair could then downturn to $1,500 and later to $1,300.

BNB/USDT

The bulls have not had the option to push BNB over the upward opposition at $320. This recommends that bears have not surrendered and they keep on selling at more significant levels.

Assuming the cost slips underneath $290, the BNB/USDT pair could drop to $265. This level is probably going to go about as serious areas of strength; however, assuming bears pull the cost underneath it, the following stop could be the basic level at $211.

The bears should break this level to flag the beginning of the following leg of the downtrend.

On the other hand, assuming the cost bounces back off $265, it will recommend that bulls are endeavoring to frame a base.

That could keep the pair stuck somewhere in the range of $320 and $265 for a couple of days. A break and close above $320 could recommend that the pair might have reached as far down as possible.

XRP/USDT

Wave’s (XRP) recuperation neglected to support above $0.45, showing an absence of interest at more elevated levels. The bears will presently endeavor to pull the cost beneath the prompt help zone at $0.40 to $0.38.

That’s what assuming they do, the XRP/USDT pair could drop to $0.33. This is a significant level to watch out for because a break and close beneath it could flag the resumption of the downtrend. The XRP/UDST pair could then plunge to the following help at $0.24.

Then again, assuming that the cost ascends from $0.38 or $0.33, the bulls will again attempt to push the pair above $0.45. Assuming they succeed, the pair could ascend to the solid upward opposition zone at $0.50 to $0.55. The bulls should clear this obstacle to propose that the downtrend might be finished.

ADA/USDT

Cardano (ADA) has been stuck in a tight reach somewhere in the range of $0.61 and $0.51 for the beyond a couple of days. This proposes an intense fight between the bulls and the bears.

If the cost slips underneath $0.51, the ADA/USDT pair could slide to the help zone somewhere in the range of $0.46 and $0.40. The bulls might mount areas of strength in this zone. Assuming the cost bounce back off this zone, the purchasers will again attempt to push the pair over the 20-day EMA. If they succeed, the pair could ascend to $0.74.

On the other hand, assuming the cost breaks underneath $0.40, the selling could get force and the pair might stretch out its decay to $0.33 and afterward to $0.28.

Related: For Crypto Business In 2022, Supporting Authorizations Is Now Open Door to Rebrand

SOL/USDT

Solana (SOL) is a major area of strength for confronting close to the 38.2% Fibonacci retracement level at $59, recommending that the feeling stays pessimistic and bears are selling on minor conventions.

Assuming the cost breaks underneath the mental level at $50, the pair could slip to $43 and from there on to $37. The bulls are probably going to shield this level energetically since, supposing that the help gives way, the downtrend could continue. The following stop on the disadvantage might be $32.

On the other hand, on the off chance that the cost diverts up from the ongoing level and transcends $59, the SOL/USDT pair could mobilize to the upward obstruction zone between the 20-day EMA ($67) and $75. A break and close over this zone could propose that the downtrend might be finished.

DOGE/USDT

Dogecoin (DOGE) keeps on exchanging underneath the breakdown level of $0.10. This proposes an absence of earnestness to purchase at more elevated levels. For the most part, sharp decays are trailed by solidifications as bulls and bears fight it out for incomparability.

The disappointment of the bulls to push the cost above $0.10 may draw in one more round of selling by the bears who will endeavor to continue the downtrend. Assuming the cost plunges underneath $0.08, the DOGE/USDT pair could drop to $0.06. Assuming this help breaks, the downfall could stretch out to the following help at $0.04.

Going against the norm, assuming the cost bounces back off $0.08, the pair might ascend to $0.10 and stay stuck inside this reach for a couple of days. The bulls should push and support the cost over the 20-day EMA ($0.10) to recommend that the descending force might debilitate.

Related: Aave price risks a 25% plunge as a classic bearish reversal pattern emerges

DOT/USDT

The bulls safeguarded the $10.37 support on May 17 yet the shallow bounce back recommended an absence of interest at more significant levels. The bears continued their selling on May 18 and pulled the cost underneath $10.37. Polkadot (DOT) could now drop to $8.

The purchasers are supposed to forcefully safeguard the zone somewhere in the range of $8 and $7.30. Assuming that the cost bounces back off this zone, the DOT/USDT pair could again endeavor an alleviation rally. The recuperation could get forced on a break over the 20-day EMA ($12.53).

But assuming bears sink the cost beneath $7.30, the selling could speed up and the pair might flag the resumption of the downtrend. The pair could then dive toward mental help at $5.

AVAX/USDT

The purchasers couldn’t push Avalanche (AVAX) over the prompt obstruction at $38. This recommends that the request evaporates at more significant levels.

The bears will currently fancy their possibilities and endeavor to pull the cost underneath the basic help at $29. if they are Effective, the AVAX/USDT both could retest the May 12 intraday low at $23.51. A break and close underneath this level could open the entryways for a further downfall to $20 and later to $18.

As opposed to this presumption, assuming that the cost bounces back off $29, the bulls will again attempt to push the pair above $38. Assuming that occurs, the alleviation rally could arrive at the 20-day EMA ($45). The bears may again represent areas of strength at this level.

SHIB/USDT

Shiba Inu (SHIB) has been merging inside the tight reach somewhere in the range of $0.000011 and $0.000014 for the beyond four days. Normally, such close ranges resolve serious areas of strength for a move.

If the cost breaks underneath $0.000011, the bears will attempt to pull the SHIB/USDT pair to $0.000009. This is a significant level for the bulls to guard because a break underneath it could flag the resumption of the downtrend. The pair could then decline to $0.000007 and later to $0.000005.

In opposition to this supposition, on the off chance that the cost turns up and breaks over the 38.2% Fibonacci retracement level at $0.000014, the bulls will endeavor to push the pair to the breakdown level at $0.000017.

TAGS-

#Bitcoin #Dogecoin #Altcoin #Ethereum #Bitcoin Price #XRPMarkets #CryptoExchange #Cardano #Price Analysis #Binance #Coins #Polkadot #Ethern #Solana #Shiba Inu