BTC (Bitcoin) is in an extensive downtrend yet three key cost measurements make sense of why merchants are sure that the $38,000 level will hold.

Bitcoin (BTC) has been not able to part from the 26-day-long slipping channel. Financial backers are awkward holding unstable resources after the United States Federal Reserve swore to decrease its $9 trillion monetary record.

While expansion has been flooding around the world, the main indications of a monetary slump displayed as the United Kingdom’s retail deals fell 1.4% in March. Additionally, Japan’s modern creation dropped 1.7% in March. Ultimately, the U.S. total national output fell 1.4% in the main quarter of 2022.

This negative macroeconomic situation can somewhat make sense of why Bitcoin has been on a downtrend since early April. In any case, one rule to examine how proficient dealers position themselves, and subsidiaries markets provide a few fantastic pointers.

Related: The concept and future of decentralized Web3 domain names

The Bitcoin prospects premium is quieted

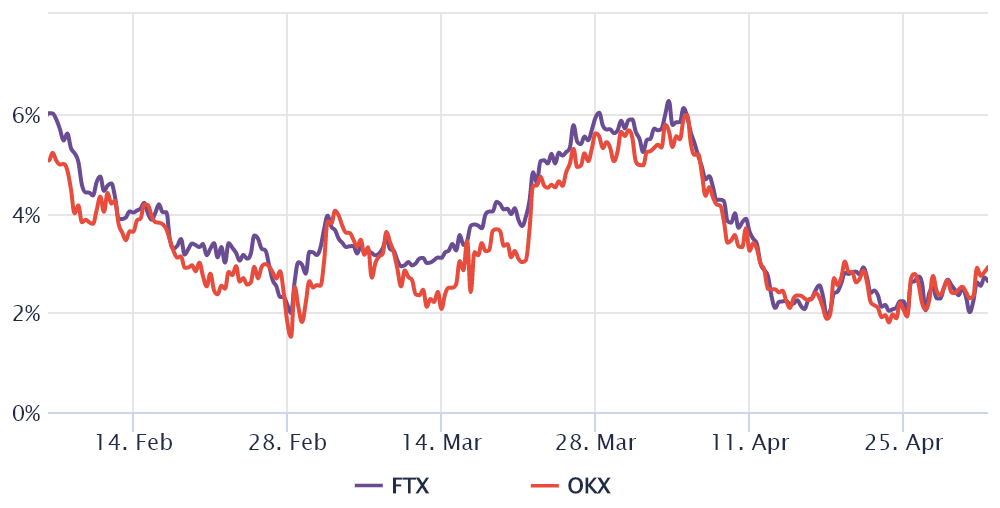

To comprehend whether the ongoing negative pattern reflects top dealers’ feeling, one ought to investigate Bitcoin’s fates contracts premium, which is otherwise called a “premise.”

Not at all like a ceaseless agreement, these fixed-schedule fates don’t have a financing rate, so their cost will contrast from ordinary spot trades.

A negative market opinion causes the three-month fates agreement to exchange at a 5% or lower annualized premium (premise).

Then again, a nonpartisan market ought to introduce a 5% to 12% premise, reflecting business sector members’ reluctance to secure in Bitcoin for inexpensive the exchange settles.

The above outline shows that Bitcoin’s fates premium has been beneath 5% since April 6, demonstrating that prospects market members are hesitant to open influence long (sale) positions.

Recent: Altcoins Auction As Bitcoin Value Drops Novel To Its ‘Large Scale Level Help’ At $38K

Choices brokers stay in the “dread” zone

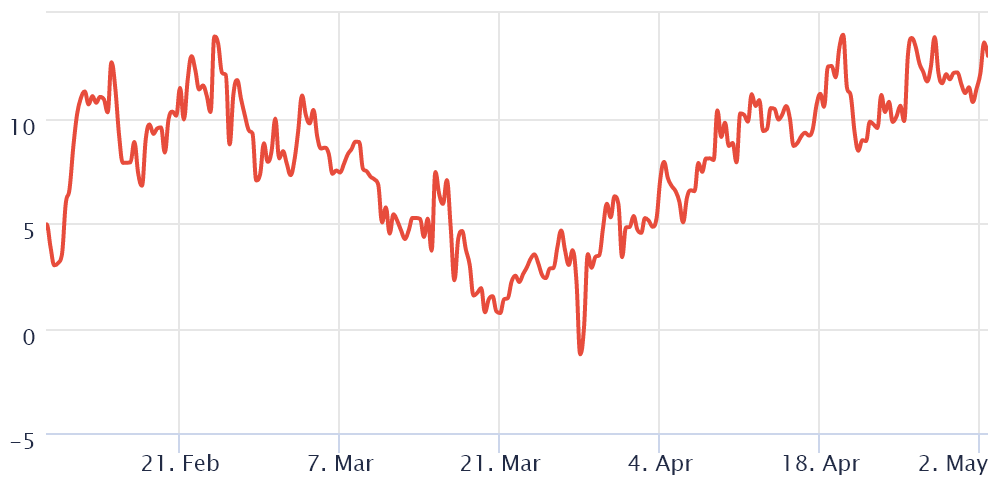

To avoid externalities well defined for the prospects instrument, merchants ought to likewise dissect the choices markets. The 25% delta slant analyzes identical call (buy) and put (sell) choices.

The marker will turn positive when “dread” is common in light of the fact that the defensive put choices premium is higher than the call choices.

The contrary holds when market producers are bullish, causing the 25% delta slant to move to the negative region. Readings between negative 8% and positive 8% are typically considered impartial.

The above graph shows that Bitcoin choice merchants have been flagging “dread” since April 8, similarl as BTC broke underneath $42,500 following a 10% drop in four days.

Obviously, such a measurement could be mirroring the 16%negative BTC cost execution over the course of the last month, so not by and large a shock.

Recent: DAOs: A blockchain-based replacement for traditional crowdfunding

Edge markets support its good faith

Edge exchanging permits financial backers to get digital money and influence their exchanging position, along these lines possible expanding returns.

For instance, a broker can purchase cryptographic money by getting Tether (USDT) to build their openness.

Then again, Bitcoin borrowers can short the digital money as they bet on its cost decline. Not at all like fates gets, the harmony between edge yearns and shorts isn’t matched all the time.

The above outline shows that dealers have been acquiring more Bitcoin as of late, as the proportion diminished from 20 on April 30 to the current 12.5. The higher the marker, the more certain expert merchants are with Bitcoin’s cost.

Regardless of some extra Bitcoin getting movement pointed toward wagering on the cost slump, edge merchants remain for the most part hopeful, as per the USDT/BTC loaning proportion.

Bitcoin merchants dread further rectification as macroeconomic pointers decay since financial backers expect a potential emergency sway on more hazardous business sectors.

In any case, there are no indications of influence short (negative) wagers utilizing edge or fates, meaning merchants need conviction at $38,000.

The perspectives and feelings communicated here are exclusive those of the creator and don’t guarantee to mirror the perspectives on Coinsfolks. Each speculation and exchanging move imply risk. You ought to lead your own examination while going with a choice.