BTC (Bitcoin) cost is in a drop and information recommends bears intend to keep the cost beneath $30,000 until the May 13 choices expiry.

Financial backers were astounded by Bitcoin (BTC) value fall to $25,500 on May 12, and this shock stretched to the choice’s brokers.

The solid revision was not limited to digital currencies and a few huge cap stocks confronted 25% or heavier week after week misfortunes in a similar period.

Developing financial vulnerability influenced S&P 500 file individuals like Illumina (ILMN), which declined by 27% through-out the course of recent days and Caesars Entertainment (CZR) confronted a 25% drop.

Shopify (SHOP), one of the biggest Canadian online business organizations likewise saw its stock dive by 28%. Dealers are scratching their heads and finding out if it’s the U.S. Central bank fixing to fault for the unpredictability.

The financial power has been expanding the loan fees and has likewise reaffirmed their arrangements to sell bonds and obligation related instruments.

While this might be the situation, dealers ought to recollect that the financial exchange mobilized 113% around to the range of 2017 and 2021, as estimated by the S&P 500 file.

Remembering that, the new slump is likewise an impression of exorbitant valuations and presumptuousness from financial backers.

Luckily, not all things have been bad for Bitcoin. On May 10, TownSquare Media, a New York-based propaganda and radio broadcasting organization, revealed speculation about $5 million in bitcoin.

Nubank, the biggest advanced bank in Brazil and Latin America, likewise declared that it will give around 1% of its net assets to bitcoin.

Related: Crypto-associated stocks hammered as COIN and HOOD drop to record lows

Bulls were shocked

Bitcoin’s drop to $25,500 on May 12 shocked bulls in light of the fact that under 1% of the call (purchase) choice wagers for May 13 have been set beneath this cost level.

Bulls could have been tricked by the new try to overwhelm $40,000 on May 4, in light of the fact that their wagers for May 12’s $610 million choices are to a great extent focused above $34,000.

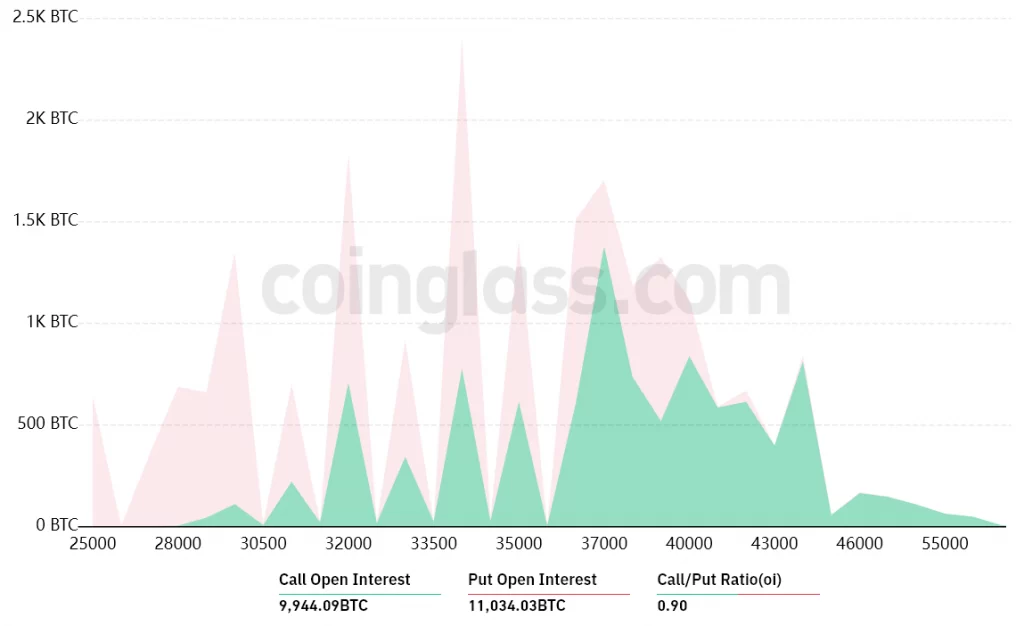

A more extensive view utilizing the 0.90 call-to-put proportion shows a slight benefit for the $320 million put (sell) choices versus the $290 million call (purchase) instruments. In any case, now that Bitcoin is underneath $30,000, the majority of the bullish wagers will become useless.

On the off chance that Bitcoin’s cost stays beneath $30,000 at 8:00 am UTC on May 13, just $1 million (sale) choices will be accessible.

This distinction happens in light of the fact that there is no use justified to purchase Bitcoin at $30,000 assuming it exchanges underneath this level at expiry.

Bears are going for the gold million benefit

The three doubtlessly situations in light of the ongoing cost activity is recorded beneath.

The number of options contracts available on May 13 for Call and Put instruments fluctuates, depending on the expiry cost. The lopsidedness inclining toward each side creates up the hypothetical gain:

- Somewhere in the range of $27,000 and $30,000: 0 calls versus 9,350 puts. The net outcome leans toward the put (bear) instruments by $260 million.

- Somewhere in the range of $30,000 and $32,000: 150 calls versus 7,500 puts. The net outcome favors bears by $220 million.

- Somewhere in the range of $32,000 and $33,000: 1,100 calls versus 5,900 puts. The net outcome benefits put (bear) choices by $150 million.

This unrefined gauge considers the put choices utilized in negative wagers and the call choices solely in impartial to-bullish exchanges. All things considered; this distortion dismisses more mind-boggling speculation techniques.

For example, a broker might have sold a put choice, acquiring positive openness to Bitcoin over a particular cost yet sadly, there is definitely not a simple method for assessing this impact.

Related: Crypto: Bitcoin Premium Downfall Now To 3 Year Low

Bears have motivating forces to smother Bitcoin cost

Bitcoin bears need to hold the cost beneath $30,000 on May 13 to get a $260 million benefit. Then again, the bulls’ most ideal situation requires a 10.7% increase from the current $28,900 to the $32,100 zone to restrict their misfortunes to $150 million.

Bitcoin bulls had $1.73 billion in utilized long positions sold throughout the course of recent days, so they presumably have less assets to push the cost higher temporarily.

With this said, bears have more prominent chances of stifling BTC underneath $30,000 before the May 13 choices expiry.

Tags-

- #Bitcoin

- #Cryptocurrencies

- #Federal Reserve

- #Bitcoin Price

- #Markets

- #Cryptocurrency Exchange

- #Stocks

- #Derivatives

- #Market Analysis

- #Bitcoin Options