How low can Bitcoin’s cost go? even the most hopeful of us should concede that we are as of now in the profundities of a bear market. As $BTC fell over half in a couple of months, elation appears to be far away. Meanwhile, a common idea might spring up in a large number of our psyches:

With many moving their perspectives promptly from 100K to 10K, it very well might be an ideal opportunity to take a top to bottom gander at the point.

Figuring out cycles-

Bitcoin’s cost has generally been secured around “dividing occasions”, where digger rewards are split. This outcome in three ensuing legs: bull, bear, and hack.

This model puts us close to the beginning of the “enormous drawdown” stage and subsequently shows costs falling further before we view it as a base.

With the ongoing financial circumstance, be that as it may, it could be great to outline three potential situations for $BTC, and what value activity will resemble in each.

Hopeful situation

The most ideal situation is one where whales are prepared to purchase the plunge with size, making enormous cost floors. This has become much almost certain with establishments and entire nations joining the space.

Central bankers and financial regulators from 44 countries enjoying their second day of talks about financial inclusion, banking the unbanked, and #Bitcoin adoption in @Bitcoinbeach and in El Salvador 🇸🇻 pic.twitter.com/OVgpwaUNyO

— Nayib Bukele (@nayibbukele) May 18, 2022

Nayib Bukele, leader of El Salvador, as of late facilitated 44 worldwide pioneers to talk on Bitcoin. On the off chance that even a couple of them take the orange pill, it could undoubtedly set off multi-billion (on the off chance that not trillion) inflows into the market.

Some striking Bitcoin whales have likewise begun purchasing once more. This could imply that costs are alluring enough for aggregation.

Save risk has likewise entered the lower bound of the purchase zone. By and large, this has brought about outsized returns, with high financial backer certainty compared with cost.

The hopeful situation here is that we are near a market cycle base. While it might take some time for a full positively trending market, Bitcoin (and even Ethereum) holders might protect current levels emphatically

Skeptical situation

With value markets falling forcefully and the large-scale viewpoint deteriorating consistently, taking into account the absolute worst scenario is significant.

Past cycles saw near 90% drawdowns, and that was without a downturn. While institutional reception is in many cases considered great, cryptographic forms of money are as yet a gamble on the resource. Would it be a good idea for them if they need to save capital, it is clear would be sold first.

Tie likewise as of late saw US$7 billion in recoveries, which could simply be the beginning of a crypto mass departure. As cash leaves the framework, there will essentially be less to purchase the plunge with.

$BTC strength is as of now battling, showing there is more agony to go. In bear markets, we for the most part see capital streaming into $BTC from alts. Being at lows implies there is conceivably a “mass trepidation” occasion for alts on the way.

As cost activity keeps on reflecting tech stocks, a large-scale risk-off climate could prompt further capitulation. On the off chance that we truly do get n 80% drawdown from the highs, 15K $BTC or lower could be a reality.

In all probability situation

$BTC has never exchanged under a past cycle’s unsurpassed highs. With the past run arriving at US$20,000, it is logical we test those levels in the end, yet all the same not go under.

$ETH predominance is additionally climbing. This demonstrates a better market, yet joined with $BTC strength, a base might be close.

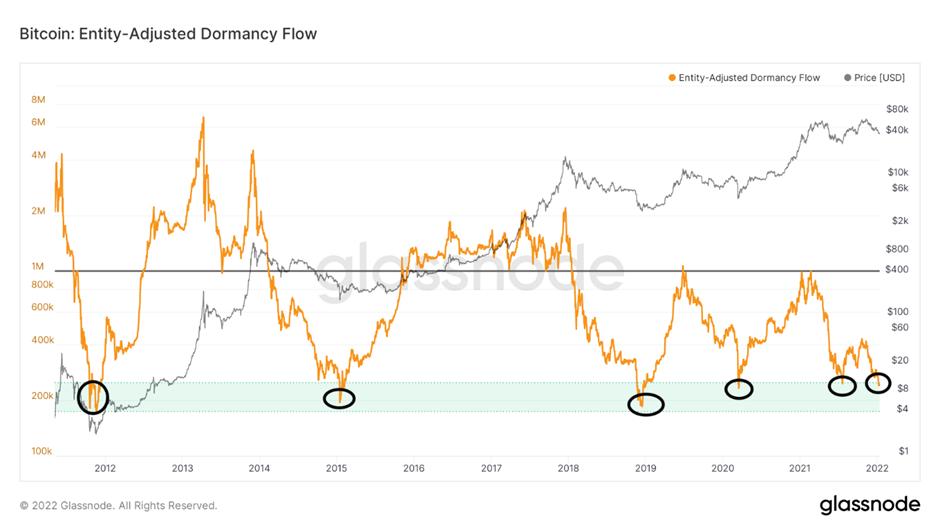

Most significant models likewise show that we are as of now at the upper limits of generational purchasing open doors.

Except if an all-out market slump happens, we likely see a drudgery down to mid or low US$20,000 until the following cycle.

Be avaricious when others are unfortunate

I call this chart "we are still early".

— Willy Woo (@woonomic) May 5, 2022

Hodling for 4 years, BTC has always outperformed every other asset class. ALWAYS. Zooming out, things become clear.

When the blue trace moves into the cluster of the other assets, #Bitcoin will have matured. pic.twitter.com/56AklFf1DD

While it may not be the specific base, purchasing at these levels is very appealing as a drawn-out financial backer. Notwithstanding the general trepidation executing the business sectors, having an arrangement and adhering to it will assist you with remaining composed in these circumstances.