Experts say (Bitcoin)BTC’s shortcoming exacerbated by institutional financial backers leaving prospects markets, but on-chain information implies that Bitcoin is in an early lining process.

The digital currency market has encountered another rollercoaster week that saw Ether (ETH) cost dip under $3,000 and Bitcoin (BTC) cost hit a new multi-month low at $37,700.

Values showcases likewise got through a sharp offer off essentially because of financial backer dread over expected changes to the size of the Federal Reserve’s next rate climb.

Until now, Bitcoin cost fell 41.72% down from its $69,000 all-time high and keeping in mind that the cost may be in what some portray to be a bear market, a more profound jump into different on-chain and subsidiaries information shows that a drop in inflows and thepivot from institutional financial backers are the fundamental elements affecting BTC cost activity.

Interminable prospects rule exchange volumes-

A ton has changed in the crypto market beginning around 2017 when the Bitcoin market was overwhelmed by spot exchanging and subsidiaries markets made up only a little part of exchanging volume.

As indicated by a new report from on-chain market knowledge firm Glassnode, Bitcoin subordinates “presently address the prevailing setting for cost disclosure” with the “future exchange volume currently addressing products of spot market volume.”

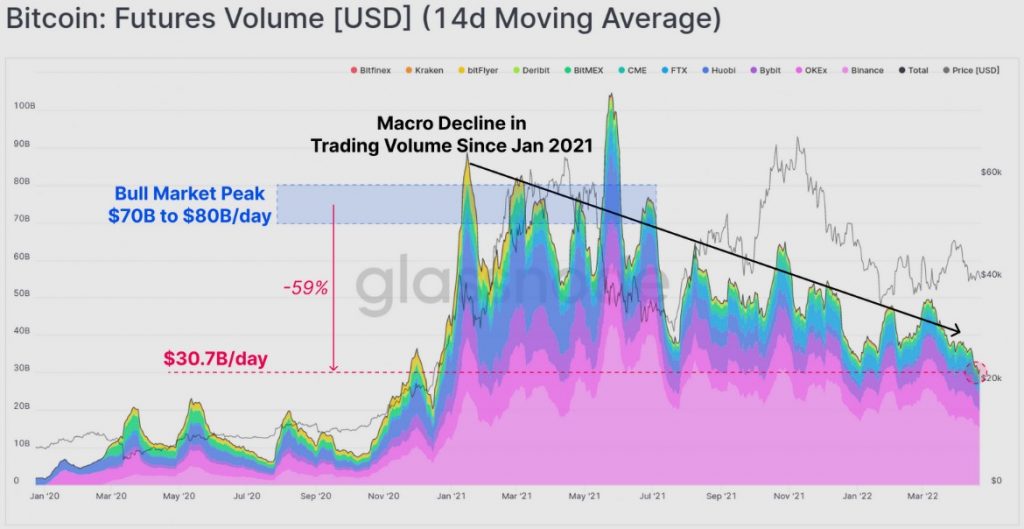

This has significant ramifications at the ongoing cost activity for BTC on the grounds that thefutures exchange volume has been declining since January 2021. The measurement is down over 59% from a high of $80 billion every day during the principal half of 2021 to its ongoing volume of $30.7 billion every day.

that equivalent time span, unending prospects have overwhelmed conventional schedule fates as the favored instrument for exchanging on the grounds that they all the more intently coordinate the spot file cost and the expenses related with taking conveyance of BTC are impressively lower than with customary items.

As indicated by Glassnode “the ongoing open revenue in interminable trades is identical to 1.3% of the Bitcoin market cap, which is moving toward generally undeniable levels.”

In spite of this, the complete exchange of capital and influence out of schedule terminating prospects has prompted a declining influence proportion, which “proposes that a sensible volume of capital is really leaving the Bitcoin market.”

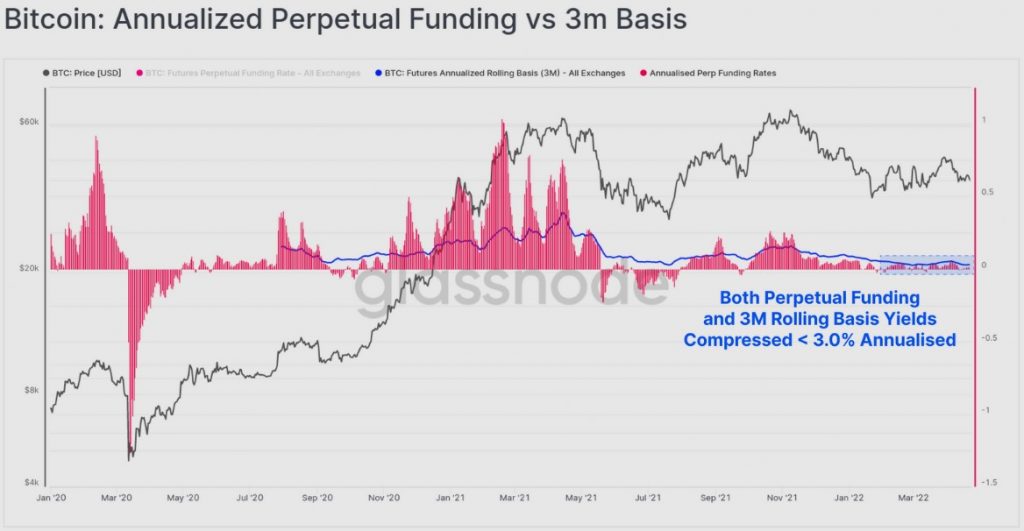

The reason for this capital turn is probable connected with the way that the yields accessible in prospects markets are presently above 3.0%, which is just 0.1% higher than the 2.9% yield accessible on the 10-year U.S. Depository Bond and well underneath the 8.5% U.S. Customer Price Index (CPI) expansion print.

Glassnode said,

“Almost certainly, declining exchange volumes and lower total open interest is a side effect of capital streaming out of Bitcoin subsidiaries, and towards better return, and possibly lower apparent gamble valuable open doors.”

Related: Trader flags BTC price levels to watch as Bitcoin still risks $30K ‘ultimate bottom’

On-anchor information focuses to enormous substance reception

Creating some distance from subsidiaries markets, positive finishes paperwork for the eventual fate of Bitcoin can be found by digging further into on-chain volume information.

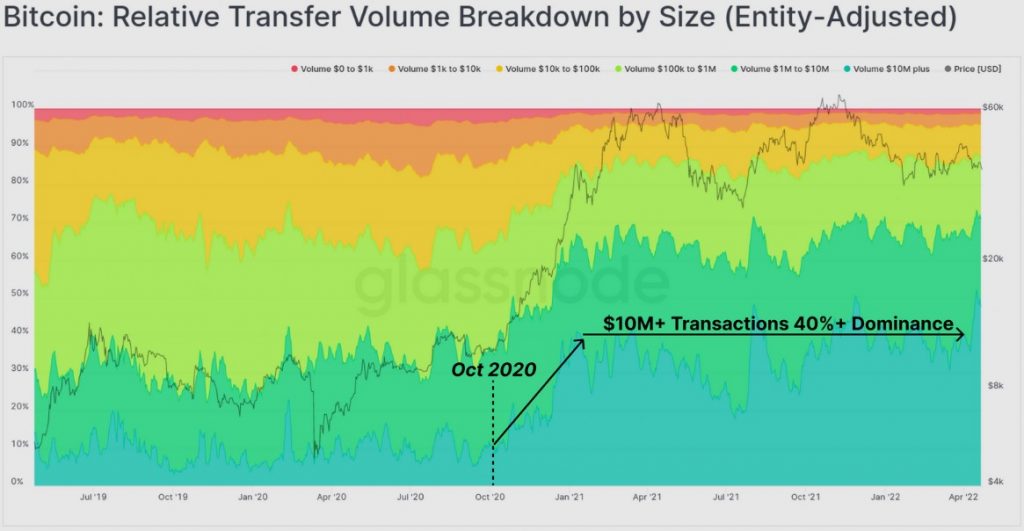

Starting in October 2020, the level of exchanges more prominent than $10 million has expanded from 10% of move volume at best to the ongoing typical everyday predominance of 40%.\

As per Glassnode, this focuses to critical development “in esteem settlement by institutional measured venture/exchanging substances, caretakers and high total assets people.”

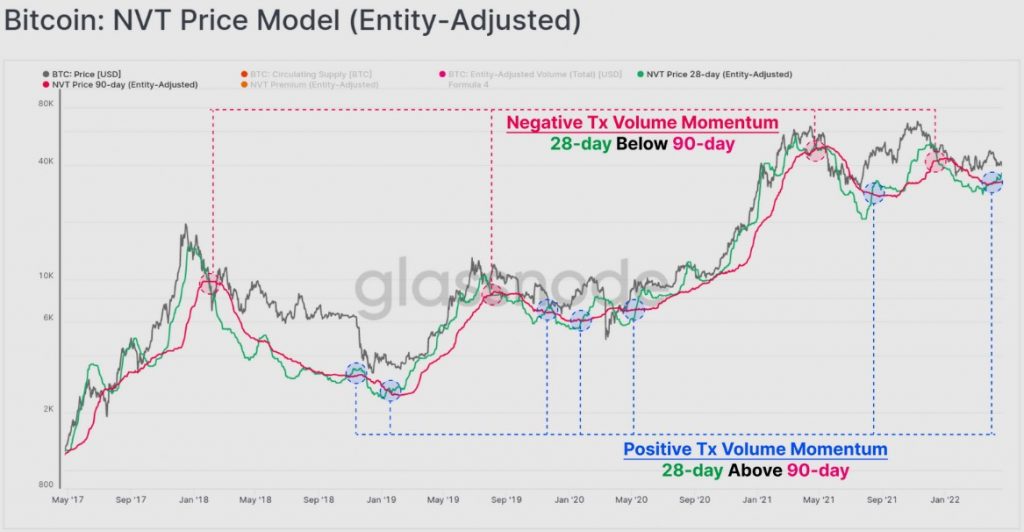

Involving total exchange volumes related to the Network Value to Transactions (NVT) Ratio, the ongoing worth of Bitcoin is somewhere in the range of $32,500 and $36,100.

As indicated by Glassnode, both the 28-day and 90-day NVT models are “beginning to reach as far down as possible and possibly converse” with the 28-day breaking over the 90-day, which has by and large “been a valuable medium to long haul signal.”

The general digital money market cap presently remains at $1.791 trillion and Bitcoin’s predominance rate is 41.5%.

The perspectives and feelings communicated here are exclusively those of the creator and don’t be guaranteed to mirror the perspectives on Cointelegraph.com. Each venture and exchanging move implies risk, you ought to lead your own exploration while settling on a choice.

Tags- #Bitcoin #Glassnode #exchanges #BTC #market #cryptocurrency

Some More-