Disintegrating tech stock costs, declining DApp use, and negative subsidiaries information keep on sticking Ether’s (ETH) costs beneath $2,000.

(ETH) 12-hour shutting cost has been regarding a tight $1,910 to $2,150 territory for twelve days, however strangely, these 13% motions have been sufficient to exchange a total of $495 million in fates contracts since May 13, as per information from Coinglass.

The deteriorating economic situations were additionally reflected in computerized resource speculation items.

As per the most recent version of CoinShare’s week-by-week Digital Asset Fund Flows report, crypto assets, and venture items saw a $141 million outpouring during the week finishing on May 20.

In this case, Bitcoin (BTC) was the financial backers’ concentration after encountering a $154 week after week net reclamation.

Russian guidelines and disintegrating U.S. tech stocks raise what is going on (Ether)

Administrative vulnerability burdened financial backer feelings after a refreshed variant of the Russian mining regulation proposition became known on May 20.

The report in the lower office of the Russian parliament at this point not contain the commitment for a crypto mining administrator’s library nor the one-year charge pardon.

As referred to by nearby media, the lawful branch of the Duma expressed that these actions would be able “potentially cause costs on the government financial plan.”

Extra tension on ETH cost came from the Nasdaq Composite Index’s 2.5% slump on May 24.

What’s more, the vigorous tech stock-driven marker was compelled after the virtual entertainment stage Snap (SNAP) tumbled 40%, referring to rising expansion, inventory network requirements, and work disturbances. Thus, Meta Platforms (FB) shares fell by 10%.

On-chain information and subsidiaries are supportive of bears

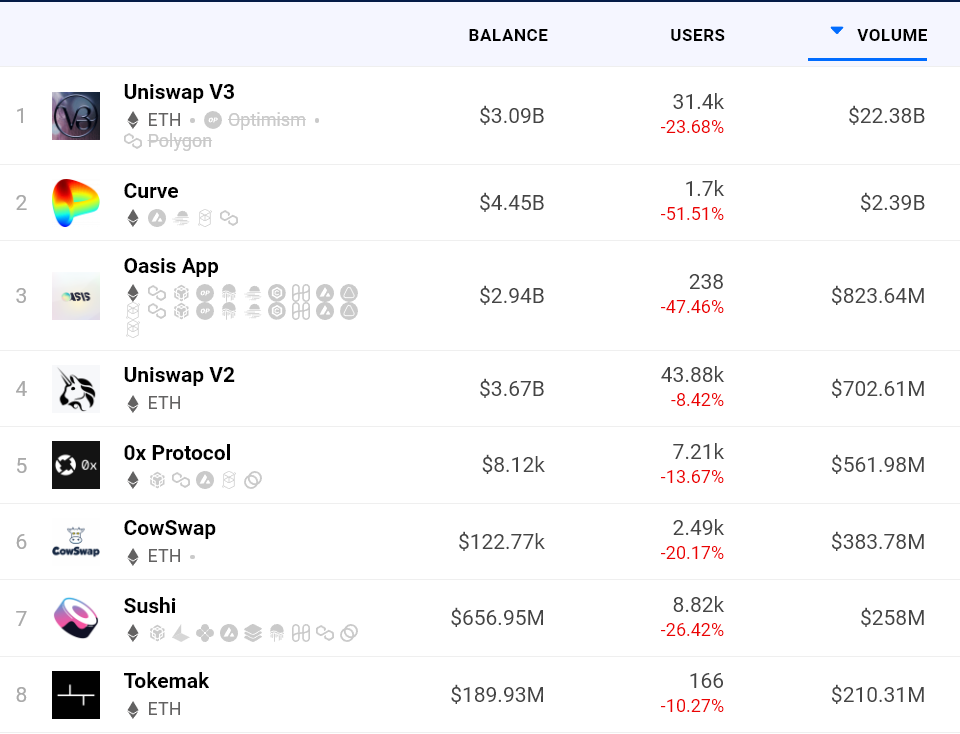

The quantity of dynamic locations on the biggest Ethereum organization’s decentralized applications (DApps) have dropped by 27% from the earlier week.

The organization’s most dynamic decentralized applications saw a significant decrease in clients. For example, Uniswap (UNI) V3 week by week addresses diminished by 24%, while Curve (CRV) confronted 52% fewer clients.

To comprehend how proficient merchants, whales, and market producers are situated, we should take a gander at Ether’s prospects market information.

Quarterly prospects are utilized by whales and exchange work areas due, principally, to their absence of a fluctuating financing rate.

These fixed-month contracts generally exchange at a slight premium to recognize markets, showing that dealers demand more cash to keep repayment longer.

These prospects ought to exchange at a 5% to 12% annualized premium in solid business sectors. This present circumstance is characterized as “contango” and isn’t restrictive to crypto markets.

Ether’s prospects contracts premium went underneath the 5% impartial market limit on April 6. There’s a clear absence of conviction from influence purchasers because the ongoing 3% premise marker stays discouraged.

Ether could have acquired 2% after testing the $1,910 channel obstruction on May 24, however, on-chain information shows an absence of client development, while subsidiaries’ data of interest toward negative opinion.

Until there are a few confidence improvements that help the utilization of decentralized applications and the Ether fates premium recaptures the 5% impartial level, the chances of the cost breaking over the $2,150 obstruction appear below.