The second-biggest digital currency by market cap, Ethereum, has taken off 45% during the previous week, beating most other beatable resources There could be a basic clarification for this:

As Ethereum’s group of engineers moves toward the determination of a long-term, very troublesome redesign, merchants are moving positively.

Ethereum Surge

The second-biggest digital currency by market cap, Ethereum, has flooded by around 45% over the last week, beating most of the main 100 crypto resources. While numerous speculations are encompassing ETH’s bullish pattern, one of the primary drivers of value developments is the approaching Ethereum consolidation.

Exchanging ETH has changed from negative to bullish as engineers draw nearer to completing a long-term, very troublesome overhaul. Since the beginning of the ongoing cost spike, the total supply of ETH has now risen to 56% in benefit, from lows of 41%.

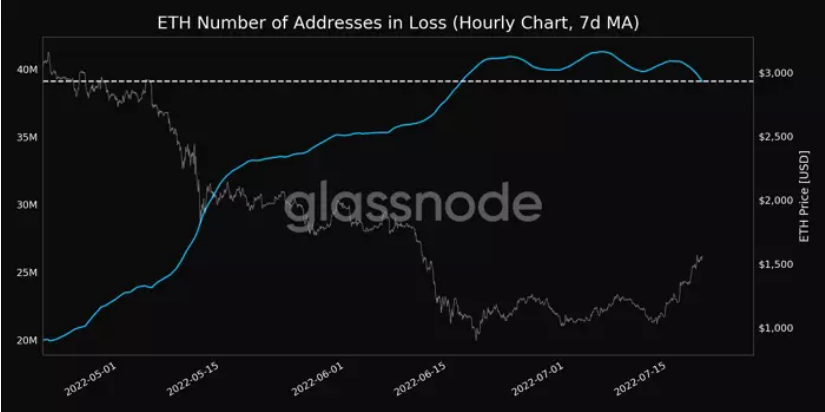

As per measurements from Glassnode, a huge getting out of short situations in the fates market was the justification for Ethereum’s 22% addition this week.

Glassnode tweeted:

“More than $98M in short fates positions were exchanged in 60 minutes, moving $ETH costs up by 12.5%.”

As of press time, 39,112,029 ETH addresses were in loss (7d MA), further evidence of ETH’s new bullish trend.

Because the final activities that will move Ethereum action to the Beacon Chain are in September, there is still plenty of time for The Merge to take place.

A member of the Ethereum community called Superphiz. eth predicted that Goerli would be the last open testnet by

The mainnet combine is expected to drift during the seven days of September 19 assuming that everything with Goerli works out as expected.

Specialists Opinion

Youwei Yang, head of the monetary investigation at StoneX, says that two “convictions” are the reason for this vertical ascent for Ethereum The first is the as of late declared time for the Ethereum “blend” update, which ought to make the organization fundamentally more energy-proficient. Yang asserts that the “quieting” of macroeconomic tensions is the second.

“As a matter of fact, on the off chance that you see the cost development tick by tick, this time it’s more similar to ETH driving BTC [or Bitcoin] rather than the reverse way around in common times, so it’s areas of strength for an of ETH-drove bear market rally with the affirmation and opinion of ETH2.0,” said Yang, alluding to post-blend Ethereum.

Nathaniel Whittemore, a popular podcaster and industry watcher, made this attestation in his latest episode of “The Breakdown.”

There is a developing figuring out that “the Merge” could impact markets on Twitter, Discord, and wherever else individuals banter cryptographic forms of money.

Following quite a while of low costs, the occasion proposes, as Whittemore put it, an “arrival of confidence” in the digital currency markets.

Similarly, The Merge fills a “story void,” allowing crypto enthusiasts to tell how the technology is changing the world.

Others accept that the Merge could be making ETH cost spike because of primary reasons. The redesign addresses an essential change in the likely uses of Ethereum by compensating financial backers who stake their resources in the organization.

A move like this could even lead to deflationary powers similar to Bitcoin, which would further benefit holders. Individuals who are buying ETH now in readiness might see it more as speculation than an exchange in this situation.

#Blockchain #Ethereum #Transactions #cryptocurrency exchange #Fees