Are you asking, to mine Solana is like mining Bitcoin or Ethereum, the response is, no? Since Solana exchange approval depends on “Verification of Stake (PoS)” dissimilar to Bitcoin or Ethereum which depends on “Evidence of Work”.

Evidence of Stake framework needs recently possessed coins which then u can stake on a validator who approves exchanges which gives the validator a prize. Then the validator gives some level of their benefit what partitions in light of the level of your portion in the all-out share.

Might you at any point mine Solana coins?

Due to its proof of stake nature, Solana cannot be mined, no matter how powerful your equipment or how deep your pockets are.

In return for remuneration, Solana offers two ways you can assist with the organization:

Using a validator, you can stake your Solana to gain rewards. Much as a bank pays revenue on your stores – in return for utilizing your reserve funds to subsidize contracts and different ventures – a Validator in the Solana organization will pay your compensations of generally 8% for permitting your coins to be marked to assist with affirming exchanges on the organization.

Approval, where you run an exceptionally fueled server in a data center that attempts to affirm exchanges on the Solana organization.

As a validator, you can procure a commission on every one of the prizes created by individuals who ‘stake’ their coins with you, but the startup expenses can be restrictive for some.

Where could I Mine Solana Coins?

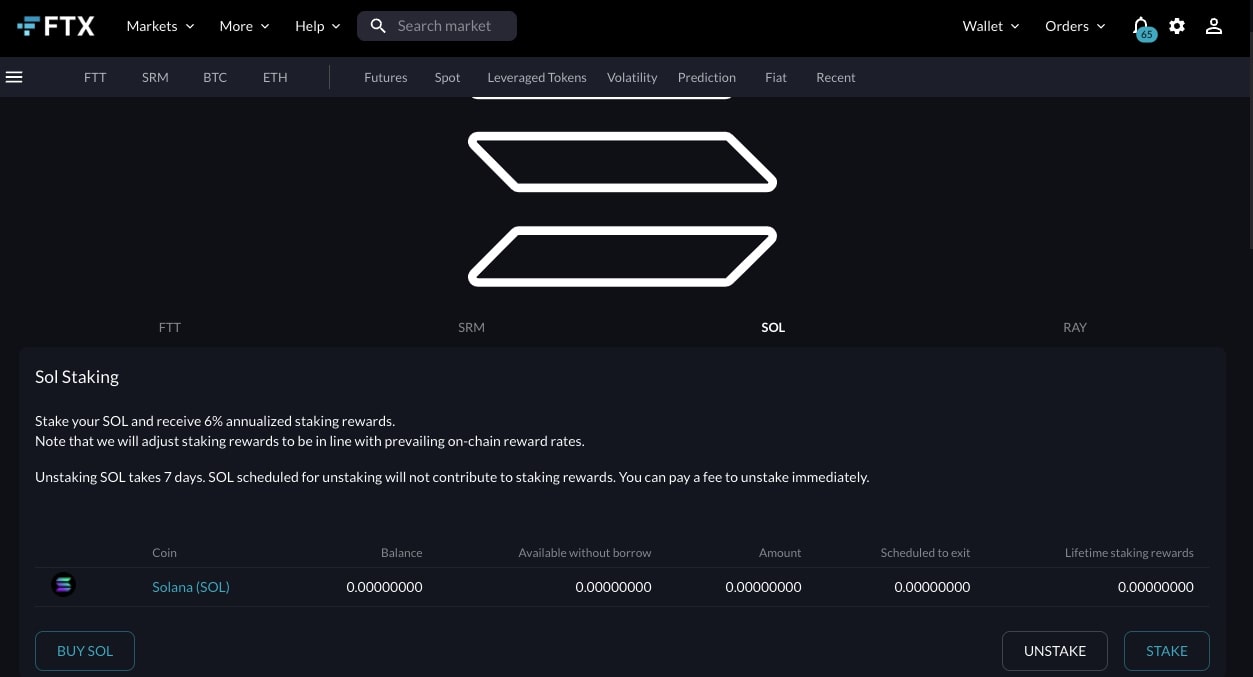

The best spot to acquire more Solana coins by ‘mining’ or ‘marking’ them is with the FTX stage. They offer low charges to purchase, sell and stake SOL tokens to procure a 6% premium paid out into your record every day.

Their foundation is likewise the most secure and most confided in overseer on the planet, with billions of dollars of resources got in their vaults. To securely mine Solana, this trade is your smartest choice.

Is it legitimate to Mine Solana tokens?

Acquiring latent prizes from the Solana (SOL) convention is lawful and is viewed as a revenue source. Your Solana mining or marking rewards are burdened in an identical way to pay, yet you might need to beware of your nearby guidelines with an expense counselor.

Mine Solana Fees and Expenses

Mine Solana tokens through concentrated stages like FTX or Binance is free. The possible charge you pay is the point at which you purchase SOL tokens from a trade. It is allowed to store and pull-out SOL into trade marking pools to acquire recurring, automated revenue.

What is Mine Solana?

Mine Solana is the most common way of approving exchanges on the Solana blockchain. Diggers are compensated with SOL tokens for their work in checking and handling exchanges. To turn into a Solana excavator, you should initially stake SOL tokens to turn into a validator.

Whenever you have marked your tokens, you will want to begin mine Solana. How many SOL tokens you procure as a prize for mining will rely upon the number?

How productive might it at any point be? Do you have a number cruncher?

For marking you can expect arrival of around 8% on the coins you stake. You might wish to check our Solana marking benefit mini-computer to play for certain numbers.

On the other side turning into a validator is a by and large unique endeavor. You’ll require significant Linux DevOps abilities, admittance to a costly server (generally $30k each year), and either your very own amazing reserve SOL (50,000 would be great) or the precious stone hands to burn through 100s of SOL yourself on casting ballot charges while you develop your own validator’s portion of stake.

What kind of equipment should be a validator?

The quicker the better, yet need to require:

- A 12+ center CPU, in a perfect world with a high clock speed (eg old Xeons might be excessively sluggish)

- 128GB RAM least

- 1TB NvME SSD or more

- Some likewise suggest a cutting Gbps GPU

- 1 Gbps unmetered association

- How’s the trouble?

- To be a Solana staker – simple! You can get everything rolling in just 3 ticks.

- To be a validator. let’s be realistic, the expectation to learn and adapt is steep!

All things considered. could you at any point suggest a Solana marking pool?

In the realm of Solana marking, we call them ‘Validators’, and you can track down our manual for picking the best Solana validators here.

You can likewise investigate our rundown of the top validators to discover some extraordinary more modest validators with great APY returns. By marking with a more modest validator, you help secure and decentralize the Solana organization, as well as frequently beating the profits in APY of the bigger validators.

We likewise run a little Solana validator ourselves that has extraordinary equipment, low dynamic stake, high APY, and is situated in a less swarmed data center.

If you choose to stake with us, you not exclusively will get an extraordinary APY return, yet you’ll do your piece to assist with decentralizing Solana and safeguard your interest in the long haul. Furthermore, you’ll likewise assist us with building more aides and apparatuses to help the environment – mutual benefit! 🤝

An option in contrast to marking straightforwardly with a validator is to utilize a Solana marking pool, where your stake will be consequently parted and circulated among various validators.