Predatory Financial, the act of offering or potentially providing a credit that is, best unfair, uncalled for, and to say the least harmful to the party getting the loan.

What is Predatory Financial?

Predatory Financial alludes to the act of offering as well as providing a credit that is, best unfair, unjustifiable, and to say the least, harmful to the party getting the loan. Predatory loaning commonly includes two key variables:

1. The loaning party makes credit terms that can’t sensibly or be met.

2. The loaning party searches out a borrower with no powerful approach to meeting the terms framed in the credit contract.

The outcome is that the borrower gets support but can’t settle the credit contract. The loaning party then benefits from the loan given, the borrower’s failure to fulfill the credit prerequisites.

Outline

Predatory Financial is the act of offering a credit that charges the borrower unreasonably significant expenses or potentially a credit that the lender realizes the borrower will not have the option to reimburse.

Loan sharks target explicit gatherings, like minorities, the old, the unschooled, and the individuals who need cash quickly for crises.

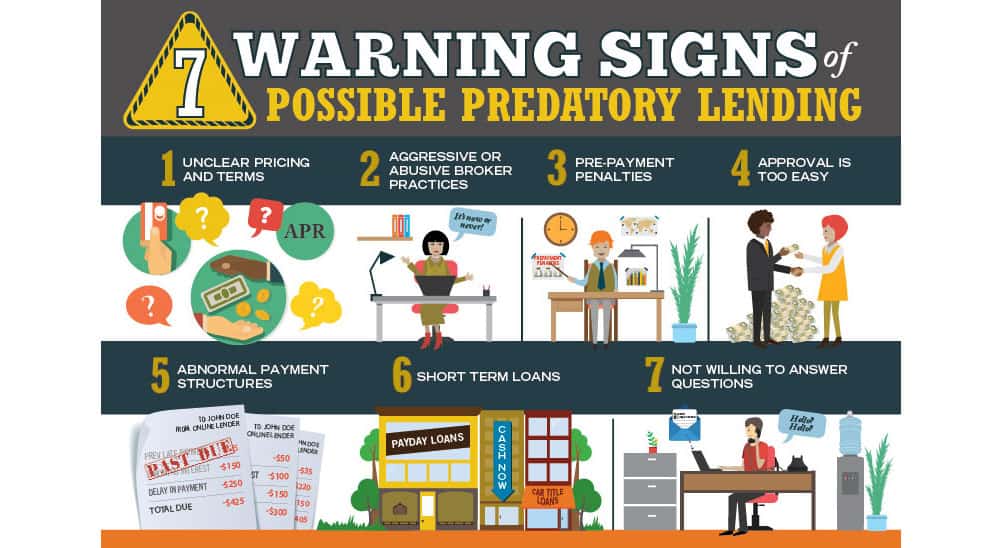

There are various advance notice signs to search for that show the money lender rehearses Predatory loaning exchange.

How Predatory Financial Works

Ruthless loaning is intended to exploit the borrower’s failure to comprehend or monetarily fulfill credit and its terms. It happens when the borrower neglects to fathom every one of the necessities illustrated in the credit arrangement.

Loan sharks commonly acquire designated clients and proposition them advances that they will always be unable to reimburse completely, or by any means. The bank takes part in such practice since it realizes it will profit from the borrower’s default on its credits.

Common beneficiaries of savage advances incorporate individuals from minority networks and the older. Loan sharks additionally target people who are less taught and the individuals who need cash rapidly to cover crisis costs, for example,

Hospital expenses

Vehicle fix bills

Home fix bills

Borrowers with terrible credit or are as of late jobless are likewise powerless against ruthless loaning.

Alerts Signs of Predatory Financial

There are six signs to search for that show predatory financial, including:

1. The fundamental expenses of the advance aren’t clear

All banks are legitimately expected to introduce every one of the expenses of a credit forthrightly. Loan sharks frequently slant the expenses or make them hard to track down or comprehend.

A borrower ought to be made mindful of the real expense of the credit and its yearly rate (all out amount of the premium in addition to every forthright charge). On the off chance that the costs aren’t clear, the loan specialist is logical a loan shark.

2. The deal appears to be unrealistic

Moneylenders frequently put out promotions that recommend they can assist with settling obligations effectively, fix harmed credit, or proposition you a marvelous credit still a horrendous record of loan repayment.

Any organization that will offer an extraordinary arrangement notwithstanding horrendous credit is a clear admonition sign. There’s probable a catch; search for buried expenses and high charges before marking anything.

3. There are objections against the lender

Research is significant before utilizing any money lender. Look online to see what different clients say regarding the lender. Assuming there are protests, it’s an indication that the loan specialist is ruthless.

4. Electronic installments are required

Lawfully, moneylenders aren’t permitted to require a client’s ledger data to assemble installments. A few moneylenders will request financial balance data, for the reason that it takes into consideration more helpful, programmed installments. The risk here is that the loan specialist might wind up utilizing the client’s ledger as an ATM. It is a bank to stay away from.

5. The lender doesn’t take a look at the reliability

Banks that don’t do a credit check before offering credit are regularly loan sharks. They don’t check the client’s obligation history and the way things were paid off. They then pack on high rates and unreasonably high forthright expenses. On the off chance that the moneylender doesn’t get some information about a client’s FICO rating or current obligations and how much pay the client procures, keep away from them.

6. The moneylender doesn’t assist with developing credit

Loan sharks will probably not report on-time advance installments to any of the three essential credit agencies. It implies that the client’s financial assessment isn’t helped, and his record as a consumer isn’t protracted. Subsequently, the client likewise will not qualify in that frame of mind for monetary items at lower costs.

Extra Resources

CFI offers the Financial Modeling and Valuation Analyst (FMVA)™ confirmation program for those hoping to take their vocations to a higher level. To continue learning and propelling your profession, the accompanying assets will be useful:

Credit score

Obligation Capacity

Non-Financial Covenants

Response Loan (Debt)

FAQ

The high cost of interest and fees is one of the reasons these types of lenders are called predatory. For example, a $100 loan with a fee of $10 that must be repaid in two weeks has an APR of 260% ($10 fee for two weeks = 10% x 26 (52 weeks/2) = 260%).

When you are unable to make payments, predatory lenders often make profits. Predatory lending may include high late fees, penalty interest rates, or even repossession of collateral (such as a car).

Fraudulent, deceptive, and unfair lending practices are used by some people to convince us to take out mortgage loans we cannot afford. As a result of high mortgage debt, the victims of predatory lending cannot afford to maintain their homes.