Bitcoin bulls are endeavoring to recover the $40,000 level and assuming this occurs, DOT, XMR, APE and CAKE could be the first altcoins to break out.

Brokers might be trusting that Wall Street will open before putting down enormous directional wagers on the grounds that Bitcoin has been related with the S&P 500 in the beyond couple of days.

The sharp fall in the U.S. value markets on April 22 recommends that financial backers are progressively anxious about the hawkish position of national banks. The market expects a 250 premise focuses rate climb by the U.S. Central bank in 2022. Likewise, the European Central Bank is supposed to raise rates interestingly starting around 2011, as per a Reuters source.

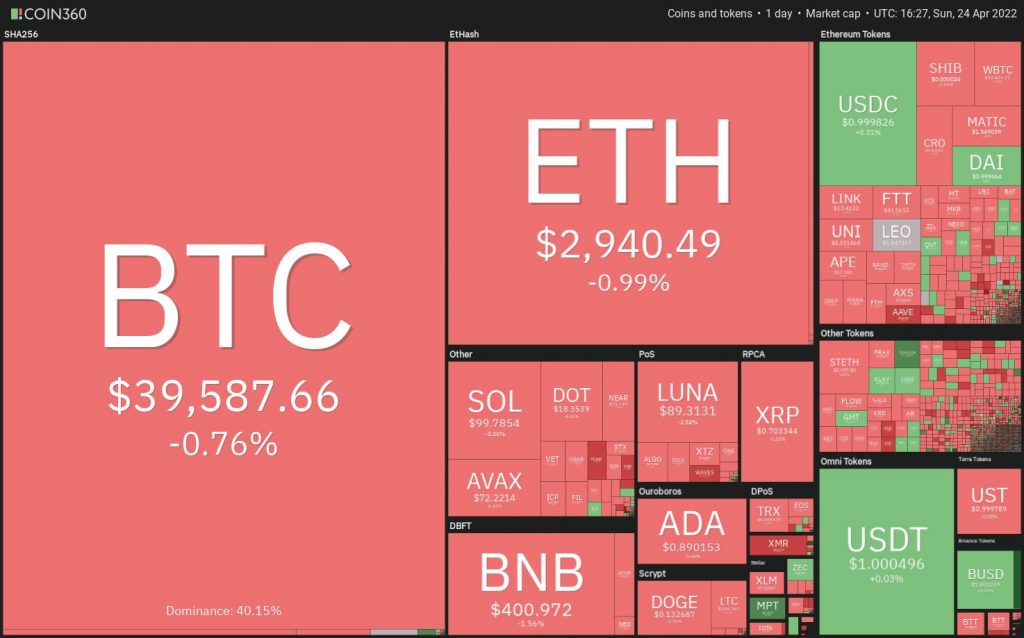

Crypto market

Coinglass information showed that financing rates across crypto subsidiaries trades stayed negative during the end of the week, flagging a negative predisposition. The inability to support a recuperation has pulled the Crypto Fear and Greed Index once again into the “intense dread” an area.

Might Bitcoin at some point draw in solid purchasing at lower levels? Assuming that occurs, select altcoins could outflank to the potential gain. We should concentrate on the outlines of the main 5 digital forms of money that show a positive graph structure.

BTC/USDT-

Bitcoin broke underneath the mental help at $40,000 on April 22 yet the bears have not had the option to expand upon this benefit. The progressive inside-day candle designs on April 23 and April 24 recommend hesitation among the bulls and the bears.

The 20-day remarkable moving normal ($41,150) is slanting down and the general strength record (RSI) is in the negative zone, demonstrating that merchants have a slight edge. In the event that bears sink and support the cost beneath $39,000, the BTC/USDT pair could drop to the help line of the rising channel. The bulls are supposed to guard this level with energy.

On the off chance that the cost bounce back off the help line with compel, it will show solid interest at lower levels. The bulls should push and support the cost over the 50-day straightforward moving normal ($41,993) to show that the rectification might be finished. The pair may then endeavor an assembly to the 200-day SMA ($47,828).

On the other hand, assuming that the cost breaks underneath the channel, the selling could increase further and the pair might drop to $34,322 and later to $32,917.

The 4-hour diagram shows that the cost is stuck inside a tight reach somewhere in the range of $39,177 and $39,980. This shows that the bears are attempting to flip the $40,000 level into obstruction. The downsloping 20-EMA and the RSI in the negative region recommend the easiest course of action is to the disadvantage.

Assuming that the cost breaks underneath $39,177, the pair could slide to $38,536. A break and close underneath this level could open the entryways for a drop to $37,000.

In spite of this presumption, assuming the cost diverts up from the ongoing level and breaks over the 50-SMA, the bullish force could get and the pair might ascend to the 200-SMA.

DOT/USDT-

Polkadot (DOT) has been exchanging close to the upward opposition at $19 for the beyond couple of days. This recommends that the bears have effectively safeguarded the level yet a minor positive is that the bulls have not surrendered a lot of ground to the merchants.

The barely down sloping 20-day EMA ($19) and the RSI in the negative zone recommend that bears have a slight edge. In the event that the cost turns down and breaks beneath $18, the chance of a drop to the solid help at $16 increments.

Alternately, on the off chance that bulls push the cost over the 50-day SMA ($19), the bullish force could get and the DOT/USDT pair might mobilize to the upward opposition at $23. The bears are supposed to mount a solid safeguard at this level.

The 4-hour diagram shows the arrangement of a sliding triangle design which will finish on a break and close beneath $18. Assuming that occurs, the pair could decline to $17 and later to $16.

So, in the event that the cost diverts up from the ongoing level and transcends the downtrend line, it might refute the negative arrangement. That could draw in purchasing and the pair might energize to the 200-SMA. A break and close over this level could flag benefit to purchasers. The pair may then endeavor a meeting to $23.

XMR/USDT-

Monero (XMR) is revising in an up-move. The cost diverted down from $290 on April 22, showing that bears are representing a solid test close to the mental level at $300.

The XMR/USDT pair could initially drop to the 20-day EMA ($245) which is probably going to go about as a solid help. Assuming the cost bounce back off this level with strength, it will prove that bulls are purchasing on plunges. The pair could of course try a break over the upward opposition at $300. Assuming that occurs, the pair might mobilize to $340.

But, assuming the cost breaks beneath the 20-day EMA, the selling could increase and the pair might slide to the 50-day SMA ($215).

The pair has dipped under the 50-SMA, showing benefit booking by momentary dealers. Assuming the cost proceeds with lower and breaks underneath $250, the selling could speed up and the pair might drop to $240 and later to the 200-SMA.

Any bounce back is going to confront selling at the 20-EMA. The bulls should push and support the cost over the 20-EMA to show that the rectification might be finished. The pair could then ascent to $280 and later to $290.

APE/USDT-

ApeCoin (APE) broke out of the balanced triangle design on April 19, demonstrating that the uncertainty among the bulls and the bears settled for the purchasers.

The 20-day EMA ($13.67) has turned up and the RSI is in the positive zone, showing that bulls are in order. There is a minor obstruction at $18.44 from where the APE/USDT pair turned down on April 23.

On the off chance that the cost diverts up from the ongoing level, the bulls will try to push the pair above $18.44. Assuming they succeed, the pair could move toward $20 and later to $24, This positive view could discredit temporarily assuming the cost turns down and breaks beneath the 20-day EMA.

The 4-hour diagram shows that the pair diverted down from $18 yet bounced back pointedly off the 20-EMA. This proposes that the opinion stays positive and merchants are purchasing on plunges. In the event that the cost supports above $17, the bulls will endeavor to continue the up-move.

Albeit the rising 20-EMA demonstrates benefit to purchasers, the RSI has framed a negative difference recommending that the forward movement might debilitate. In the event that the cost diverts down from the ongoing level and slips underneath the 20-EMA, the selling could strengthen and the pair might slide toward the 50-SMA.

CAKE/USDT-

PancakeSwap (CAKE) as of late skipped off the downtrend line, showing that the bulls had flipped the level into help. The cost broke over the 20-day EMA and is endeavoring to arrive at the 200-day SMA ($11.52).

The 20-day EMA ($8.69) and the 50-day SMA ($7.71) are turning up slowly and the general strength file is in the positive domain, Assuming that purchasers drive and support the cost over the 200-day SMA, the CAKE/USDT pair could ascend to $13.50 and later to $15.

The pair might then down to the 20-day EMA. Assuming that the cost bounce back off this help, it will expand the chance of a break over the 200-day SMA. This positive view could refute assuming the cost breaks beneath the 50-day SMA.

The moving midpoints on the 4-hour diagram have turned up and the RSI is in the positive region, showing that bulls have the high ground. Assuming that they succeed, the pair could get energy.

As opposed to this suspicion, assuming the cost diverts down from the ongoing level, the bears will endeavor to pull the pair beneath the 20-EMA. That’s what assuming they do, the pair might slide to the 50-SMA and later to the 200-SMA. A break and close beneath this help could propose that the bears are ready to take care of business.

#Bitcoin #Altcoin #Cryptocurrency #Price #Market #NFT #Analysis

More To Read –