Bitcoin holds; other cryptos are blended. Crypto costs are eccentric.

Most signs have pointed descending, however anticipating cost patterns in the long stretches of time ahead are troublesome; major cryptos have a blended day.

Costs-

Bitcoin (BTC): $31,083 +1.4%

Ether (ETH): $2,353 +3.4%

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Polygon | MATIC | +7.6% | Smart Contract Platform |

| Solana | SOL | +4.0% | Smart Contract Platform |

| Polkadot | DOT | +3.9% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Algorand | ALGO | −0.9% | Smart Contract Platform |

| EOS | EOS | −0.9% | Smart Contract Platform |

| Filecoin | FIL | −0.3% | Computing |

Bitcoin holds around $31K

Bitcoin and ether shuddered, yet Terra’s LUNA trembled in Tuesday exchanging.

The local badge of the Terra environment was as of late down more than 53% throughout the course of recent hours after the association’s UST stablecoin kept on missing the mark on its dollar stake.

And in the midst of a report that the Luna Foundation Guard (LFG), the non-benefit laid out to help the Terra organization, was planning to raise $1 billion to reestablish this equality.

The downfall followed a 30% drop on Monday. UST was as of late in the red more than 6%.

In the mean-time, bitcoin’s generally 1.4% upswing addressed an improvement over the earlier day when the biggest digital money by market capitalization dove underneath $30,000 in early Tuesday exchanging the initial time since July 20 it had fallen beneath this limit. Bitcoin was as of late exchanging simply above $31,000.

Ether, the second-biggest crypto by market cap, beat over a similar period, rising roughly 3.5%, and was switching hands up $2,350.

Other cryptos were blended for a significant part of the day with AXS as of late off more than 6%, however CRO and image coin SHIB in the green over 8% and 10%.

The crypto business kept on feeling the shockwaves of more extensive international and financial unrest.

Crypto trade goliath Coinbase missed its most memorable quarter income gauges in the midst of a 44% decrease in exchanging income from the final quarter. Excavator Riot likewise missed investigators’ forecasts for its initial three months of 2022.

Cryptos’ less wild Tuesday followed value files, which were blended in with the tech-weighty Nasdaq ascending about a rate point and the Dow Jones Industrial Average falling.

Financial backers will be peering toward the April customer cost file report, as would be considered normal to show that expansion eased back yet costs stayed high.

In messaged remarks, Jaime Baeza, CEO of Miami-based crypto mutual funds ANB Investments noticed the strain of macroeconomic occasions,

including expansion and a fixing of national bank financial strategy on stocks and computerized resources yet ascribed the latest drop-off in bitcoin “to the de-stake of the UST.

” Baeza composed that LFG’s choice to safeguard the stake by selling bitcoin holds “sped up the selloff of the more extensive crypto market as frenzy spread, and a darker swan foundational risk occasion lingered nearer.”

In a meeting, Joseph Kelly, CEO of bitcoin monetary administrations firm Unchained Capital, referred to the de-stake as “an unnerving title thing.”

However, he added hopefully: “It’s a unique little something that you get to hold rather than bitcoin as a more strong, more logical resource that isn’t overpromising and attempting to do things like keep a dollar stake. It’s one way that Bitcoin keeps on sparkling over the long haul.”

Markets

S&P 500: 4,001 +0.2%

DJIA: 32,160 – 0.2%

Nasdaq: 11,737 +0.9%

Gold: $1,839 – 0.8%

Anticipating crypto markets is testing

The last week in crypto has shown a colossal unpredictability, that scarcely any resources can coordinate.

Markets have lost more than $1 billion as Terra’s UST stablecoin was lost its 1:1 dollar stake and the crypto majors fell, carrying with it a lot of liquidations.

There’s a ton to unload about the breakdown of Terra’s UST. Presumably the most un-saw some part of it was the Luna Foundation Guard’s choice to loan out practically the whole of their stores to showcase creators to help the $1 UST stake by explicitly making exchanges set apart to $1.

Some place there’s hypothetical legitimacy to this, but the market saw LFG’s stores at fundamentally low levels and pushed to exchange however much, it could.

Related: For Crypto Business In 2022, Supporting Authorizations Is Now Open Door to Rebrand

The planning of the U.S. Central bank’s report on stablecoins could never have been something more.

“These weaknesses might be exacerbated by an absence of straightforward in regards to the hazard and liquidity of resources backing stablecoins,” the report read, with Nellie Liang,

The Treasury Department’s undersecretary for Domestic Finance, adding at an occasion, “They can possibly create undermining runs assuming the worth of the resources backing the stablecoin decline suddenly.”

In many ways, stablecoins were one of the post-March 2020 heritages. They should make genuine utility and acknowledgment for the resource class and reflected developing institutional interest.

All things considered, before March 2020, stablecoins had a market cap of simply more than $5 billion. Now that number is nearer to $175 billion.

Some could imagine that this triple whammy of the de-fixing of UST (and its logical disappointment), a fierce decrease in crypto costs and a judgment of stablecoins by the Fed would put the resource class in a problematic position. It would be a trial of confidence and conviction.

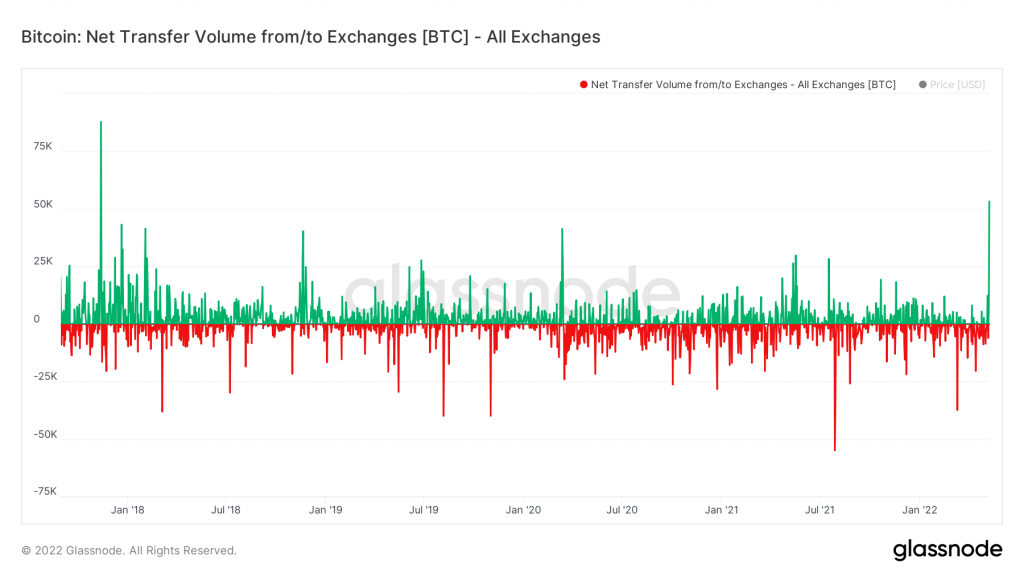

Of course, a few information recommends that very thing. Bitcoin is streaming into trades at a speed unheard of since November 2017.

A little more than 50,000 bitcoins went into trades on Monday. Customarily, trade inflow implies that dealers are preparing to sell their resources, which is viewed as a negative sign at costs.

However, it additionally implies that dealers may be planning to make a play for the subordinate’s market. In this situation, they would open long situations to speed up their benefits as the cost of crypto recuperates.

Think about what occurred during November 2017. As Glassnode information shows, there was a lot of bitcoins on trades.

It was the pinnacle of the underlying coin offering bubble and the cost of bitcoin kept on appreciating – in spite of every one of these bitcoins on trades.

Indeed, there was a subordinate’s market, as BitMEX sent off in 2014, yet at the time it was still somewhat unsophisticated and wouldn’t grow up until 2018.

The fact is, this resource class, at the end of the day, still in its earliest stages.

There are many signs we can use to help explore through the market, yet by the day’s end, crypto’s eccentricism implies these pointers mean forecasts and are not authoritative.

Professional’s take

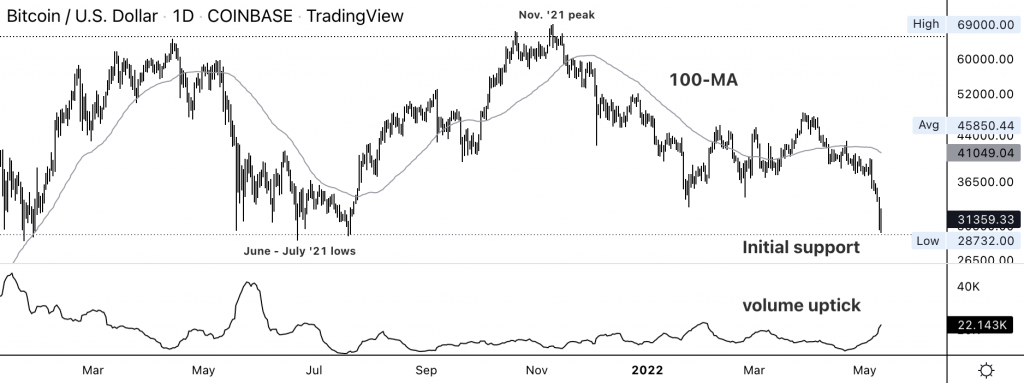

Bitcoin Holding Support at $30K, Resistance at $35K

Bitcoin (BTC) settled at around the $30,000 support level, which could keep momentary purchasers’ dynamic. In any case, potential gain has all the earmarks of being restricted, at first toward the following obstruction level at $35,000.

BTC rose by as much as 4% throughout the course of recent hours. It’s somewhere near 16% throughout the last week.

A few option cryptos (altcoins) are beating BTC throughout the course of recent hours, proposing a more prominent hunger for risk among momentary dealers.

Regularly, BTC declines not exactly altcoins during market recuperations on account of its lower risk profile comparative with more modest tokens.

The general strength record (RSI) on the day-to-day graph is ascending from outrageous oversold levels, which could uphold a short alleviation rally like what happened in late January.

This time, be that as it may, negative energy signals have expanded the opportunity of extra breakdowns on the graph.

Further, the 14-day moving normal of volume (in view of Coinbase trade information given by TradingView) ticked higher, which could be an underlying indication of capitulation.

Tags–

- #Bitcoin

- #Cryptocurrencies

- #Bitcoin Price

- #Investments

- #New York

- #Buy

- #Cryptocurrency Investment