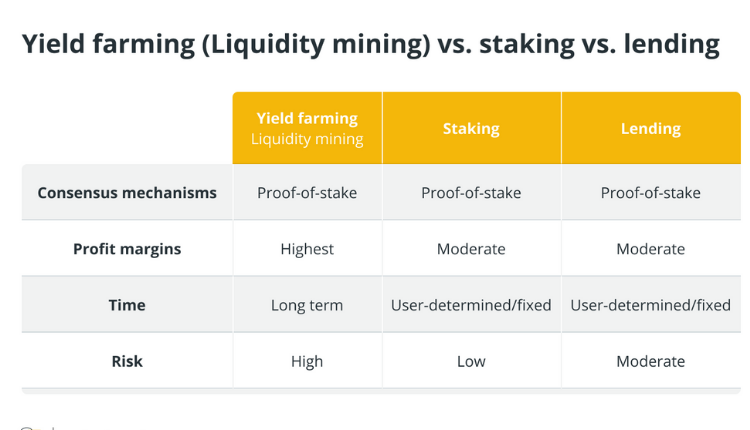

Execution of fluid marking tends to troubling value vacillations and assists clients with producing higher awards by consolidating marking payouts and DApp yield.

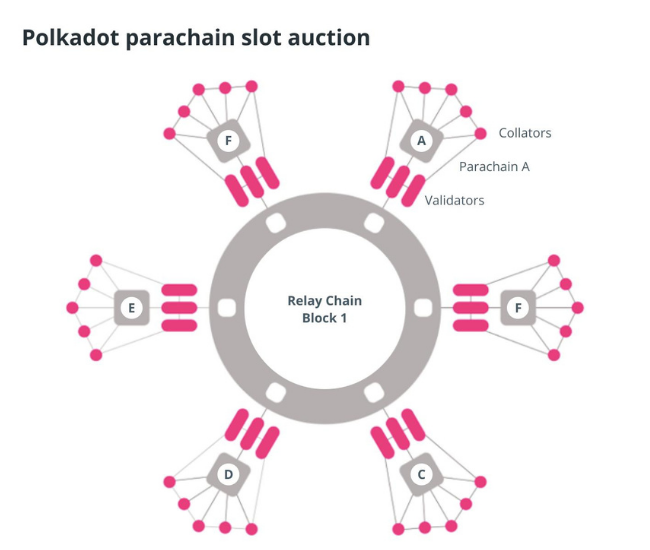

The previous summer, Polkadot made its own smidgen of history in the wake of affirming the initial five undertakings to possess para chain spaces on its canary organization Kusama.

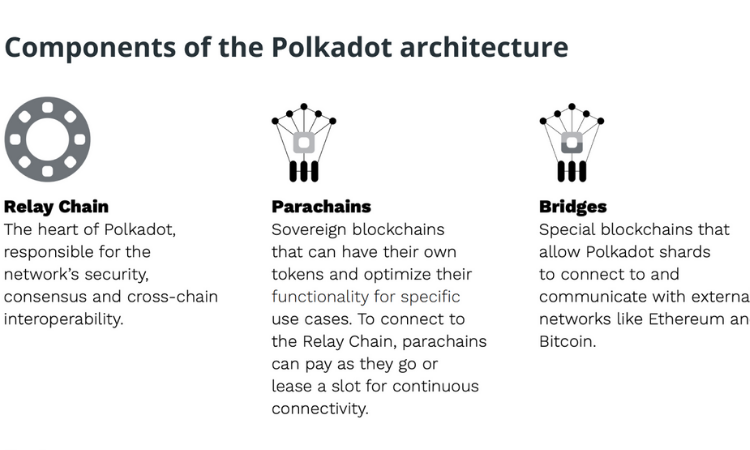

Different blockchains that bolt onto Polkadot’s principal Relay Chain for security, yet are generally autonomous, parachains address a better approach for carrying on with work in blockchain.

A maximalist vision pointed toward improving adaptability and administration while allowing the chance of forkless updates. The five tasks were Karura, Moonriver, Shiden, Khala, and Bifrost.

Fast forward to precent and the chief cluster of para-chains are ready to lapse, delivering Extra than 1 million locked Kusama (KSM) coins into the market.

Considering that KSM’s ongoing stock is 9 million, essential financial matters direct that the cost will endure, as tokens that was beforehand out of reach will unexpectedly return dissemination.

Cost vacillations, obviously, influence marking and fluid marking- however, the last development permits clients to use their tokens in any event, when they’re locked.

Related: How much intrigue is behind Kusama’s parachain auctions?

Having your (DApp) cake and eating it

All of us know about marking: It’s the most common way of “locking” tokens into a framework as insurance to get an organization. In return for one’s interest in such an undertaking, rewards are gathered.

Inside Polkadot’s perplexing selected evidence of-stake (NPoS) biological system, stakers can either be nominators (whose job it is to designate validators they trust) or validators, however, in the two cases, a similar monetary motivation applies.

The issue, as portrayed above, occurs toward the finish of a marking period. It’s fine and dandy getting liberal compensations forgetting the Relay Chain (also a few equal chains), but rather assuming the cost of the local symbolic plunges, it could make a joke of the whole endeavor.

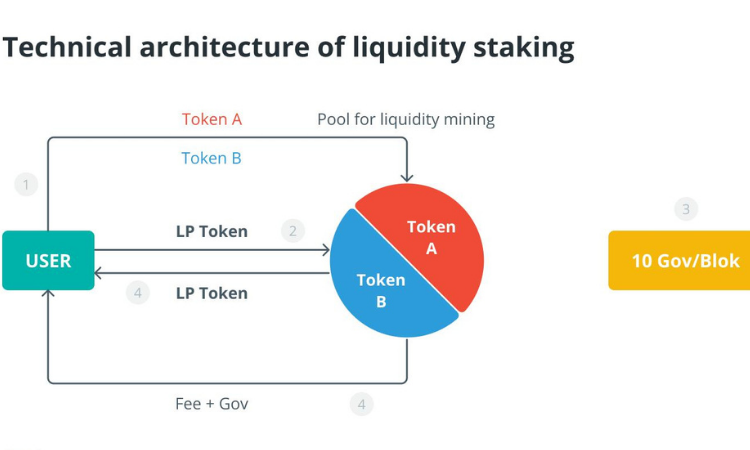

While fluid marking doesn’t safeguard the hidden cost of the marked resources, it apparently empowers clients to securely open on-chain liquidity and make the most of yield-bearing open doors presented by various decentralized applications.

This is made easy through the outlet of a different mark that addresses the worth of one’s stake. With this fluid subsidiary basically going about as the local token available, the gamble of unexpected cost insecurity following the finish of an unbounding period is tended to.

This model empowers clients to keep up with their liquidity and use the fundamental token, whether through moving, spending or exchanging as they see fit.

For sure, stakers might involve their subsidiaries as a guarantee to acquire or loan across various environments to take part in other decentralized finance (DeFi) potential open doors.

Furthermore, best of all, marking rewards keep on gathering on the first resources secured in the marking contract.

Related: How liquid staking disrupts parachain auctions on Polkadot

Yet, what happens while the marking time frame closes, I hear you inquire. Indeed, the subordinates are just traded back for the local coins to keep a consistent flowing inventory.

More or less, it’s an instance of having your cake and eating it.

The eventual fate of verification of stake?

The evidence of-stake agreement system has been under an undeniably brilliant spotlight, especially as we draw nearer to the carry out of PoS for Ethereum 2.0.

The blockchain’s for some time mooted change to verification of stake is supposed to lessen its energy utilization by more than close to 100%, passing on ecological pundits to guide their rebuke to Bitcoin and its questionable evidence of-work model.

There is no question that PoS is the naturally solid choice, regardless of whether a PoW analysis is exaggerated because of a further developing energy framework leaned toward by excavators.

Regardless of the numerous upgrades, the agreement instrument has made to its ancestor, nonetheless, there is still work to be finished.

A long way from being a settled science, verification of-stake is an advancement that can and ought to be refined. What’s more, we can begin by expanding the number and capacities of PoS validators.

This was the thought behind Polkadot’s NPoS model, which looked to join the security of PoS with the additional advantages of partner casting a ballot.

In my view, fluid marking expands upon those benefits by tackling a well-established situation looked at by clients: whether to secure their tokens or use them in DeFi decentralized applications (DApp).

Related: No, DeFi Is Not A Repeat Crisis! Of 2008 “Too Big To Fail.

This problem doesn’t just torment clients, obviously; it harms the by and large DeFi scene. For some digital currencies, the level of circling supply secured marking can outperform 70%.

At the hour of composing, for instance, right around 3/4 of Solana’s SOL tokens are marked — and more than 80% of BNB, as indicated by Statista.

It doesn’t take a virtuoso to know that having quite recently 30% of a symbolic stock accessible for use in DApps is a net negative for the business in general.

While confirmation of stake frameworks needs a functioning marking local area to guarantee security, DApp designers need to work with exchanges — and exchanges need tokens.

The rise of fluid marking has consequently been invited by the two players and especially by DApp makers, who have been compelled to offer increasingly high APYs to persuade clients their resources are best conveyed in worthwhile DApps than marking contracts.

TAGS-

- #Blockchain #Proof-of-Stake #Auction #Technology #Adoption #DApps

- #DeFi #Polkadot #Liquidity