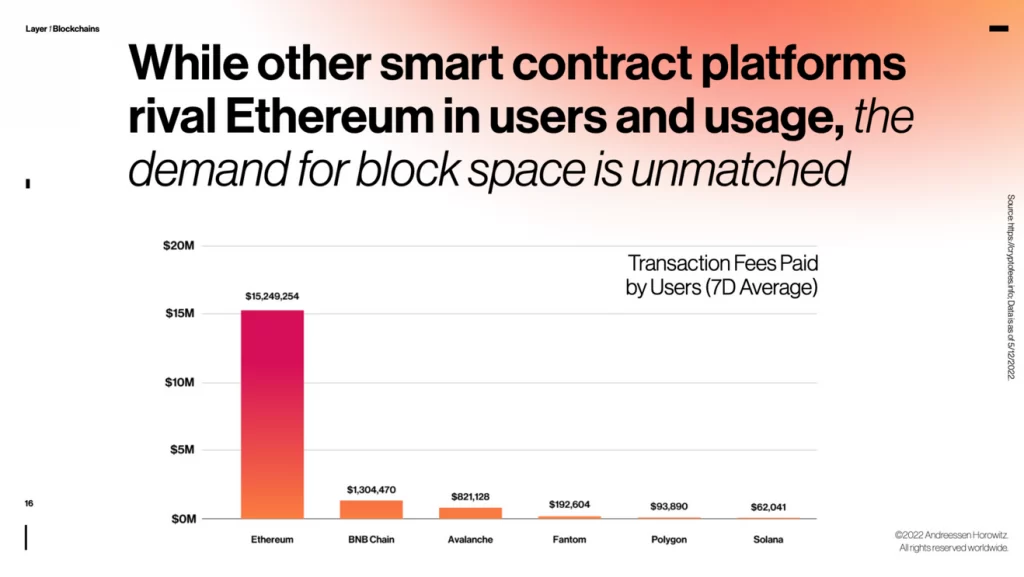

“Ethereum’s mind-boggling mindshare makes sense of for what reason its clients have been willing to pay more than $15 million in charges each day on normal just to utilize the blockchain,” a16z expressed.

Crypto adventure store monster Andreessen Horowitz (a16z) has featured that turn of events and request on Ethereum is “unequaled” regardless of the organization’s high exchange expenses.

The firm cautions, in any case, that its “fame is likewise a two-sided deal” given Ethereum focuses on decentralization over scaling, bringing about contending blockchains taking part of the overall industry with “guarantees of better execution and lower charges.”

The remarks came through a blog entry presenting a16z’s 2022 “Territory of Crypto” report, with the association’s information researcher Daren Matsuoka, head of convention plan and designing Eddy Lazzarin, General Partner Chris Dixon, and head of content Robert Hackett all cooperating to give five vital action items from the review.

Beyond Ethereum, the report centers around subjects like Web3 improvement, crypto reception rates, decentralized finance (DeFi) and stablecoins.

Introducing a16z’s 2022 State of Crypto Report

— a16z (@a16z) May 17, 2022

A lot has changed since we started investing in crypto nearly a decade ago.

Here are 5 key takeaways from the a16z crypto web3 industry survey and data analysis by @darenmatsuoka, @eddylazzarin, @cdixon & @rhhackett ⬇️ pic.twitter.com/JFLXbNh03u

As indicated by information from the report, Ethereum overshadows the opposition as far as manufacturer interest, as the organization has around 4,000 dynamic months to month engineers contrasted with second-positioned Solana (SOL) at 1,000. Bitcoin (BTC) and Cardano (ADA) are next in line at approximately 500 and 400 each.

Related: Metaverse Be the New Internet! hoping 2022, Will It Be?

That’s what the examiners noticed “Ethereum’s lead has a lot to do with its promising beginning, and, the wellbeing of its local area” however underlined the meaning of improvement proceeding to flood on the organization regardless of high exchange costs:

“Ethereum’s staggering mindshare makes sense of for what reason its clients have been willing to pay more than $15 million in charges each day on normal to use the blockchain — exceptional for such a youthful undertaking.”

The interest for Ethereum can likewise be seen across the report’s assessed exchange charges paid on a blockchain north of a seven-day normal (determined as of May 12), With the information showing that Ethereum represents $15.24 million. To give contrast, BNB Chain, Avalanche, Fantom, Polygon and Solana represent generally $2.5 million worth of expenses consolidated.

The report takes note of that Layer-1 scaling arrangements are battling to cut Ethereum’s charges down and exchange speeds up, while likewise bringing up those anticipated overhauls are coming to Ethereum to make the organization more proficient and financially savvy.

The “hotly anticipated” redesigns can’t occur soon enough anyway and a16z additionally featured in the report that north of a 30-day normal (as of May 12), dynamic locations and exchanges on contending blockchains including Solana, BNB Chain and Polygon are as of now well in front of Ethereum.

Related: Ethereum analytics firm Nansen acquires DeFi tracker Ape Board

The information shows that Ethereum has 5.5 million dynamic tends to that record for 1.1 million everyday exchanges, while Solana has a mammoth 15.4 million dynamic locations and 15.3 million day to day exchanges.

BNB Chain positions in third with 9.4 million and 5 million, while Polygon added up to around 2.6 million and 3.4 million. The investigators finished up it won’t be a champ brings home all the glory circumstance.

“Blockchains are the hit result of another registering wave, as PCs and broadband were during the ’90s and 2000s, and as cell phones were somewhat recently. There’s a great deal of space for advancement, and we accept there will be various champs.”

Other key action items from the report incorporated the DeFi area’s all out esteem locked of generally $113 billion would make it 31st biggest bank in the U.S., assessments that Web3 reception could hit 1 billion clients by 2031 and that NFTs have produced $3.9 billion worth of income for makers up to this point.