Crypto Sell-Off, BTC was generally flat throughout the course of recent hours and somewhere around 6% over the course of the last week. Brokers stay careful.

Bitcoin (BTC) balanced out around $36,000 and was generally level on Friday.

The cryptographic money exchanged with lower instability throughout recent hours, contrasted and the previous sharp auction in cost.

Elective cryptos (altcoins) were additionally somewhat stable on Friday, in spite of the fact that GALA rose by as much as 9%, beating different tokens on the CoinDesk 20 rundown. Likewise, Algorand’s ALGO token was up by 12% throughout recent hours.

Rough cost activity over the course of the last week kept on reflecting vulnerability among dealers, particularly as macroeconomic dangers wait.

On Thursday, the Bank of England (BOE) climbed loan costs and cautioned general society about a financial slump.

That set off feelings of trepidation of stagflation, or high expansion and slow monetary development, among financial backers.

The BOE’s dismal viewpoint was something contrary to the U.S. Central bank’s peppy tone on Wednesday, which in brief guaranteed financial backers that U.S. monetary circumstances could endure higher rates.

By and large, the shift from accommodative money related arrangement to extra prohibitive measures has prompted a loosen up of theoretical movement among worldwide financial backers.

This year that could be a wind blowing for stocks and cryptos

Over the present moment, cost activity stays nonpartisan, and some altcoins have profited from brief cost spikes.

Most recent costs–

●Bitcoin (BTC): $35,928, −0.71%

●Ether (ETH): $2,683, −1.28%

●S&P 500 day to day close: $4,123, −0.57%

●Gold: $1,883 per official ounce, +0.47%

●Ten-year Treasury yield everyday close: 3.12%

Bitcoin, ether and gold costs are taken 1:30 am india. Bitcoin is the Bitcoin Price Index (XBX); Ether is the Ether Price Index (ETX); Gold is the COMEX spot cost. Data about Crypto Indices can be found at coindesk.com/lists.

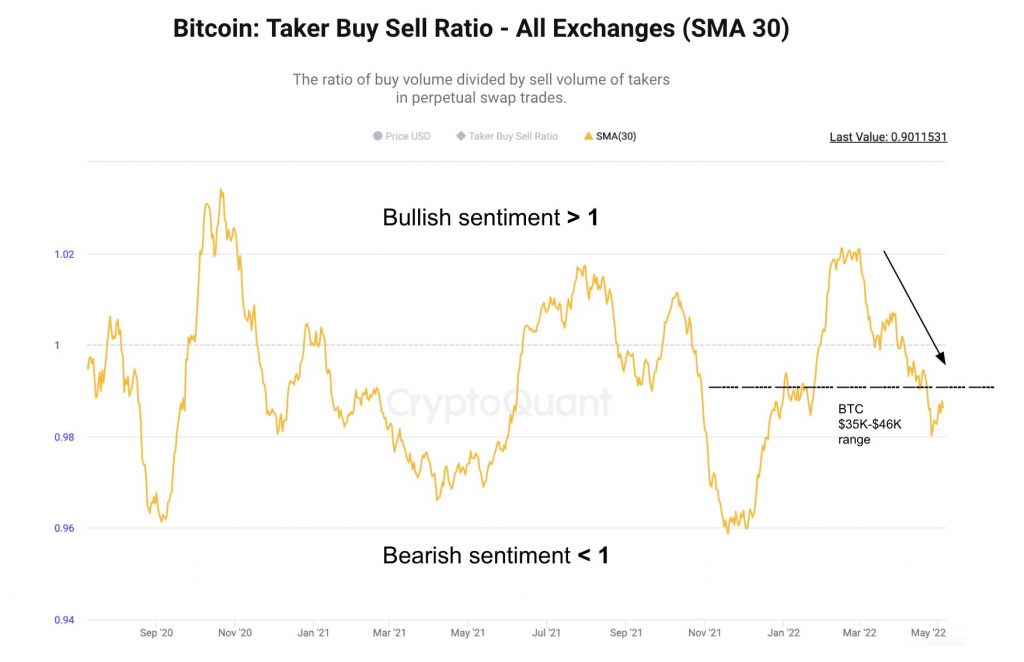

The outline beneath shows the proportion of trade volume versus sell volume in the bitcoin interminable fates market. Readings under one show negative feeling among merchants, like what happened during past slumps in cost.

BTC’s most recent cost range somewhere in the range of $35,000 and $46,000 happened close by a determined downtrend in the buy/sell volume proportion.

That proposes a few purchasers have stayed on the sideline regardless of transient adjustment in cost

Ether holding up versus bitcoin

Ether (ETH) is somewhere near 4% throughout the last week, contrasted and a 6% decrease in BTC.

Ordinarily, ETH fails to meet expectations BTC during down business sectors.

This time, nonetheless, uneven exchanging conditions have covered the ETH/BTC proportion in a tight reach over the course of the last year.

A conclusive breakout or breakdown from the ongoing reach could affirm a gamble on or risk-off climate.

Bitcoin’s strength proportion, or BTC’s market cap comparative with the absolute crypto market cap, ticked lower throughout recent days.

That recommends altcoins have encountered less offering pressure comparative with bitcoin, and that implies merchants are yet alright with extra gamble.

Altcoins decline not exactly bitcoin during rising business sectors as a result of their higher gamble profile.

In any case, like the BTC/ETH cost proportion, a breakout or breakdown in the predominance proportion would affirm the following stage for crypto markets.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Algorand | ALGO | +11.7% | Smart Contract Platform |

| EOS | EOS | +1.1% | Smart Contract Platform |

| XRP | XRP | +0.7% | Currency |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Dogecoin | DOGE | −2.0% | Currency |

| Solana | SOL | −1.9% | Smart Contract Platform |

| Cardano | ADA | −1.3% | Smart Contract Platform |

Relevant insight–